%%{init: {"theme": "white", "themeVariables": {"fontSize": "48px"}, "flowchart":{"htmlLabels":false}}}%%

flowchart TD

BayesianMethods("BayesianMethods") --> MarketingDataScience("Marketing Data Science")

style BayesianMethods fill:#ff3660

style MarketingDataScience fill:#1790D0

Bayesian Methods in Modern Marketing Analytics

PyMC Labs Online Meetup - May 2023

Mathematician & Data Scientist

Webinar’s Objective

Present some selected applications of Bayesian Methods to solve marketing data science problems in the industry.

Outline

- Introduction

- Geo-Experimentation

- Media Mix Models

- Customer Lifetime Value

- Causal Inference

- Revenue-Retention Modeling

- References

Applied Data Science

%%{init: {"theme": "white", "themeVariables": {"fontSize": "48px"}, "flowchart":{"htmlLabels":false}}}%%

flowchart TD

BusinessProblem("Business Problem") --> Model("Model")

Model --> Product("Product")

Product --> Measure("Measure")

Measure --> Stakeholders("Stakeholders")

Stakeholders --> BusinessProblem

style Model fill:#a0cdf7

Bayesian Methods

We need to explicitly describe our assumptions through the data-generating process.

Allow to include domain knowledge and constraints through priors.

Flexibility.

Uncertainty quantification.

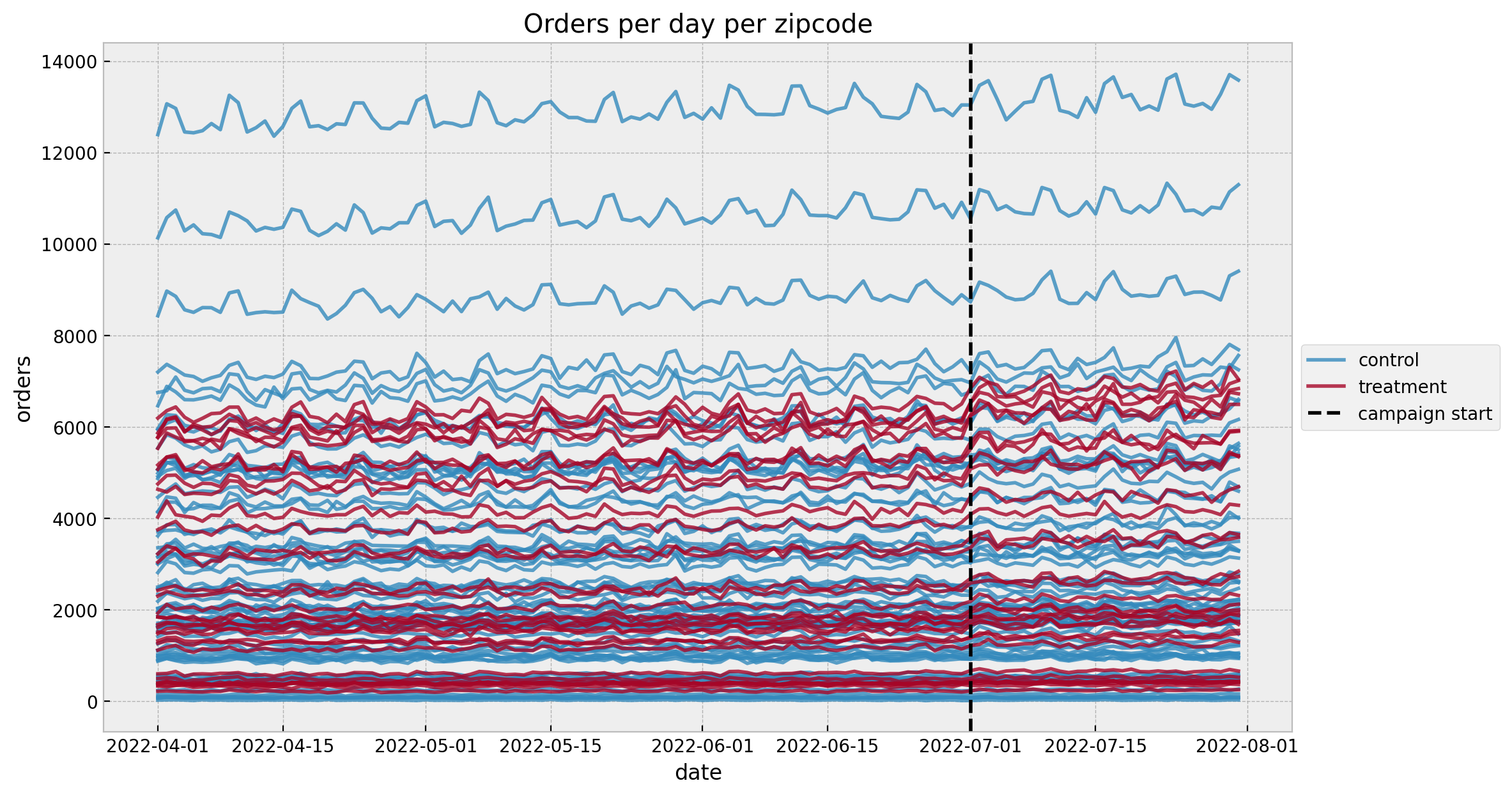

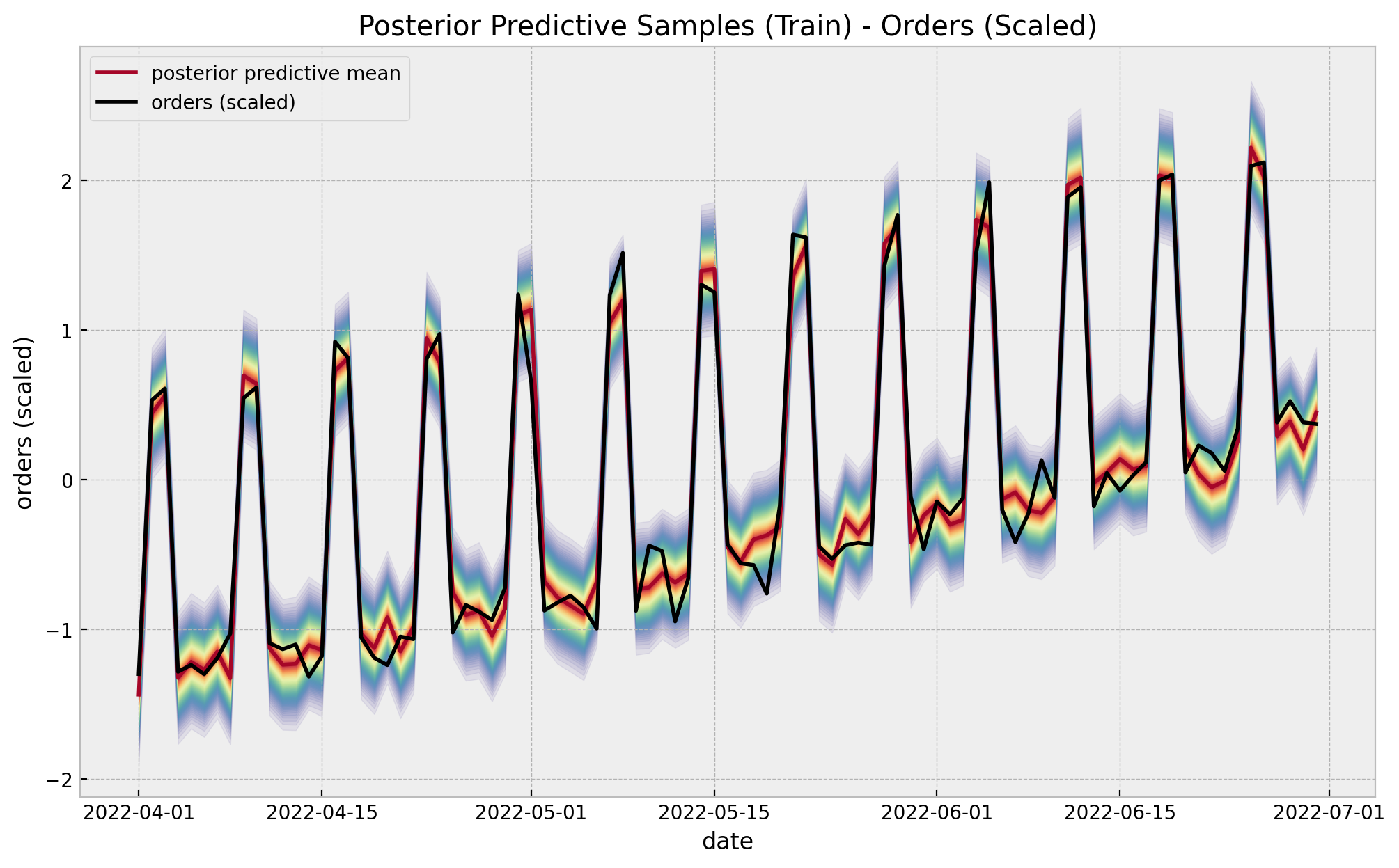

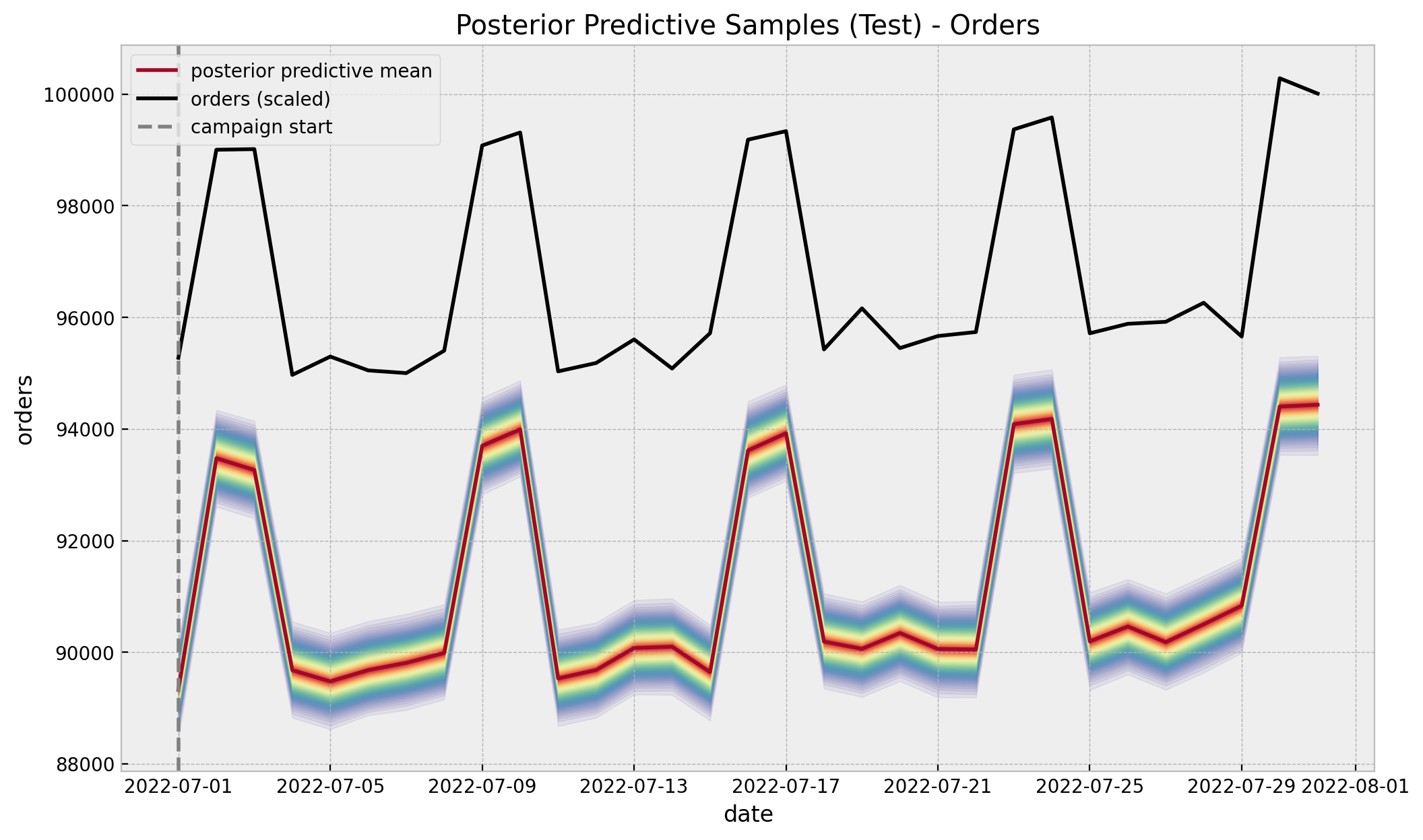

Geo-Experimentation

Time-Based Regression

Regression Model in PyMC

with pm.Model() as model:

# --- Data Containers ---

model.add_coord(name="date", values=date_train, mutable=True)

y_control_data = pm.MutableData(

name="y_control_data", value=y_control_train_scaled, dims="date"

)

y_treatment_data = pm.MutableData(

name="y_treatment_data", value=y_treatment_train_scaled, dims="date"

)

# --- Priors ---

intercept = pm.Normal(name="intercept", mu=0, sigma=1)

beta = pm.HalfNormal(name="beta", sigma=2)

sigma = pm.HalfNormal(name="sigma", sigma=2)

nu = pm.Gamma(name="nu", alpha=20, beta=2)

# --- Model Parametrization ---

mu = pm.Deterministic(

name="mu", var=intercept + beta * y_control_data, dims="date"

)

# --- Likelihood ---

pm.StudentT(

name="likelihood", mu=mu, nu=nu, sigma=sigma, observed=y_treatment_data, dims="date"

)Marketing Measurement

%%{init: {"theme": "white", "themeVariables": {"fontSize": "48px"}, "flowchart":{"htmlLabels":false}}}%%

flowchart LR

Experimentation("Experimentation") --> MMM("Media Mix Model")

MMM --> Attribution("Attribution")

Attribution --> Experimentation

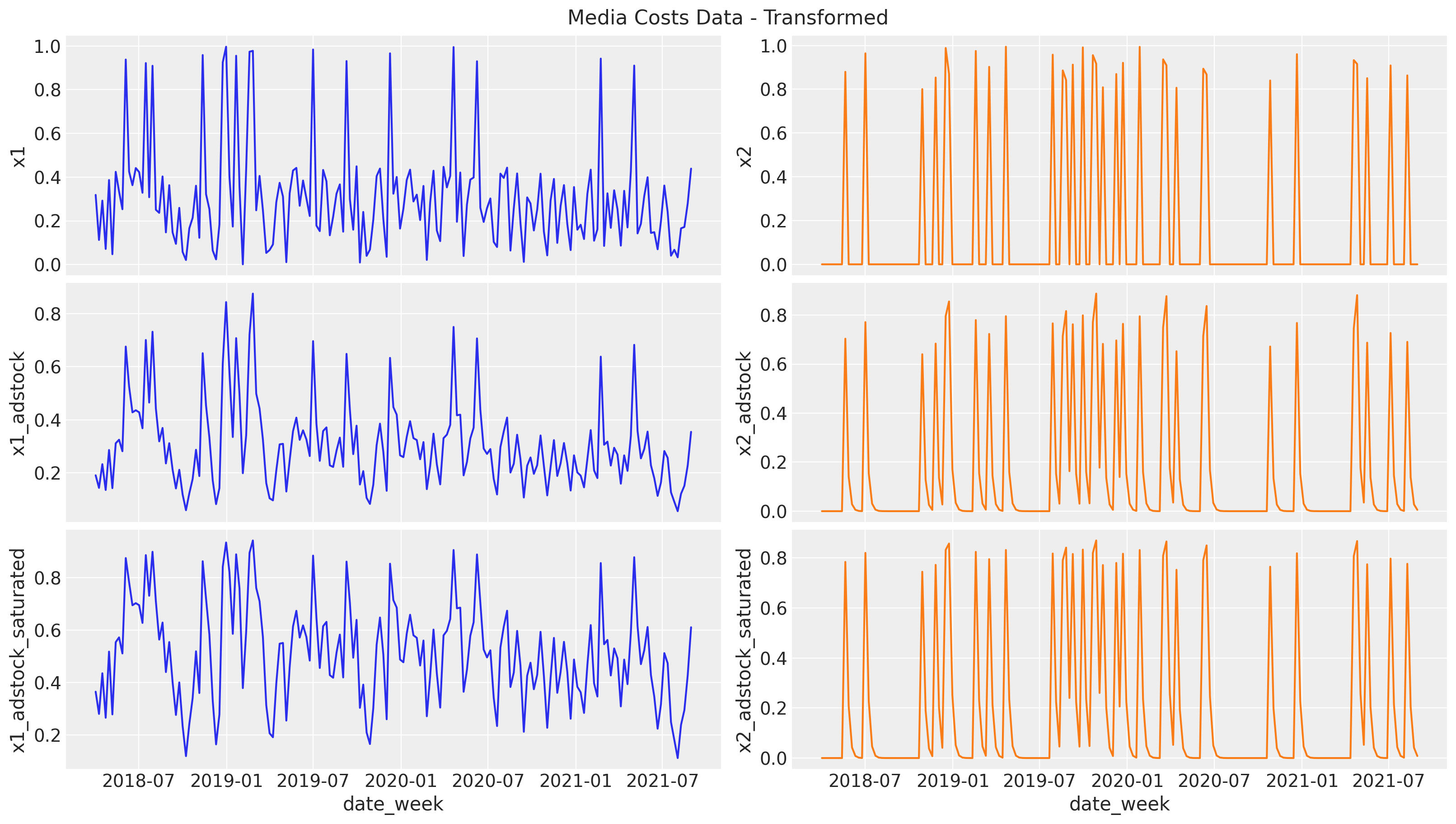

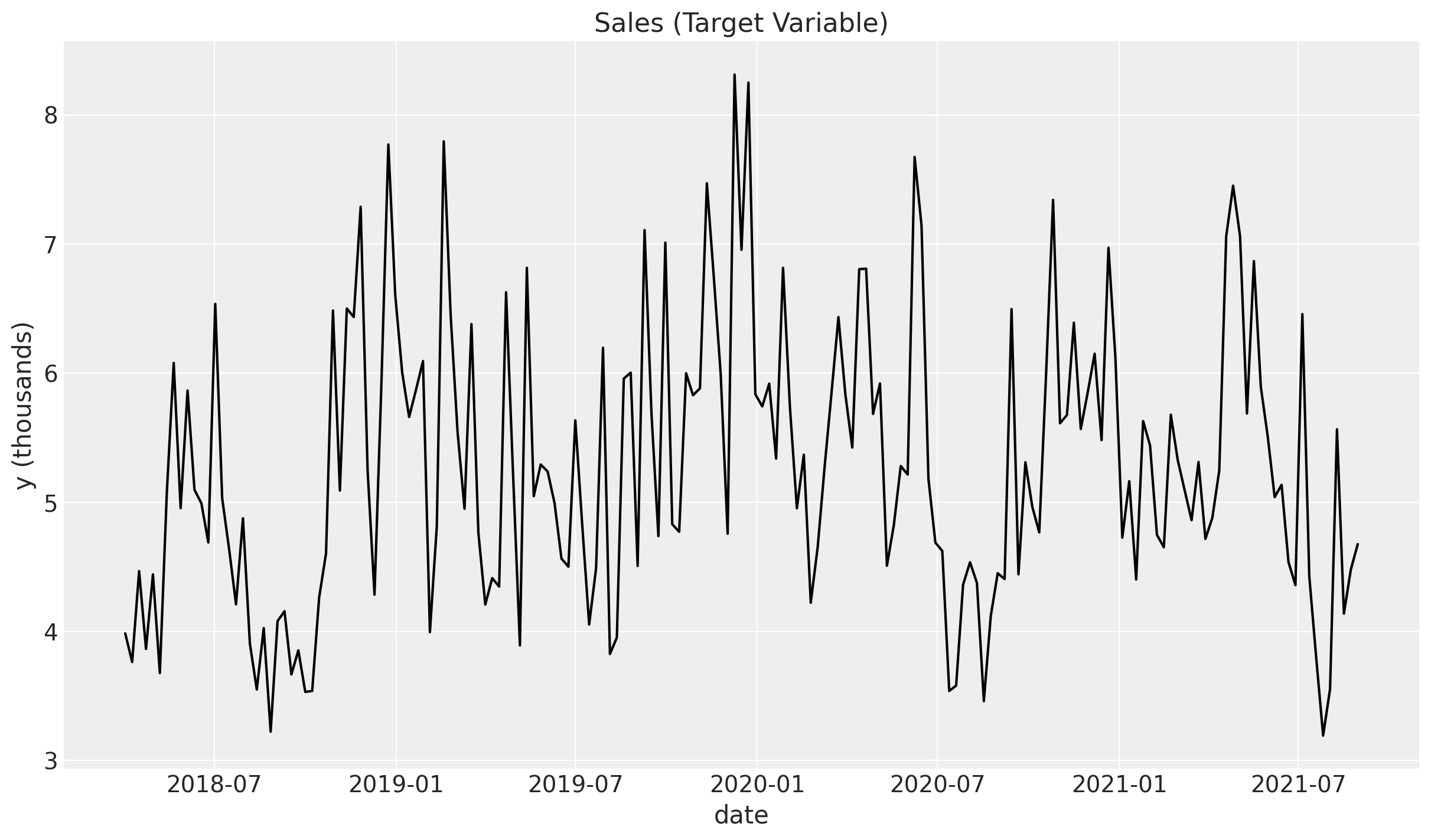

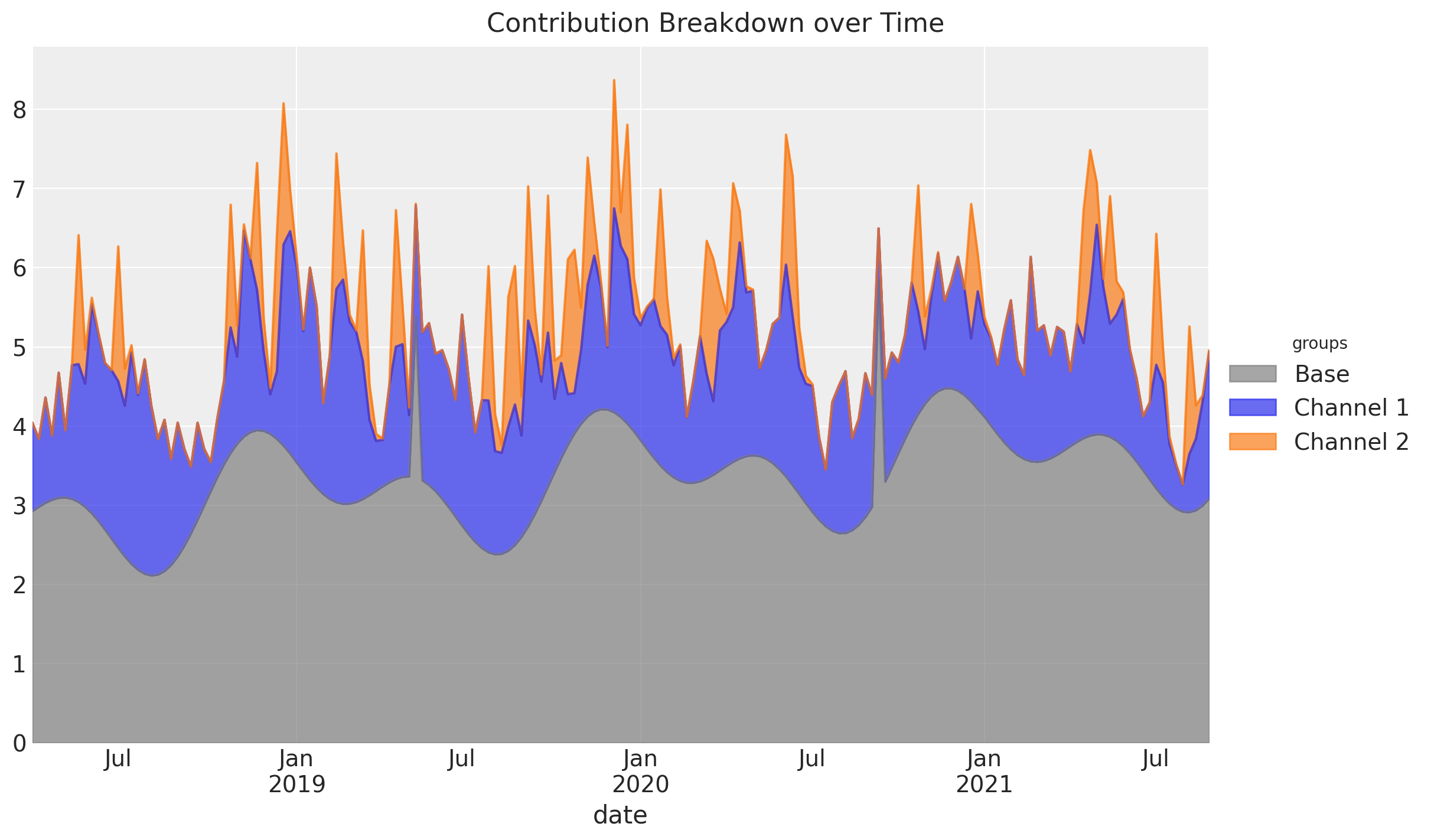

Media Mix Models

Media Mix Models (MMM) are used by advertisers to measure the effectiveness of their advertising and provide insights for making future budget allocation decisions.

Media mix models are also used to find the optimal media mix that maximizes the revenue under a budget constraint in the selected time period.

Media Transformations

Carryover (Adstock) & Saturation

Media Mix Model Target

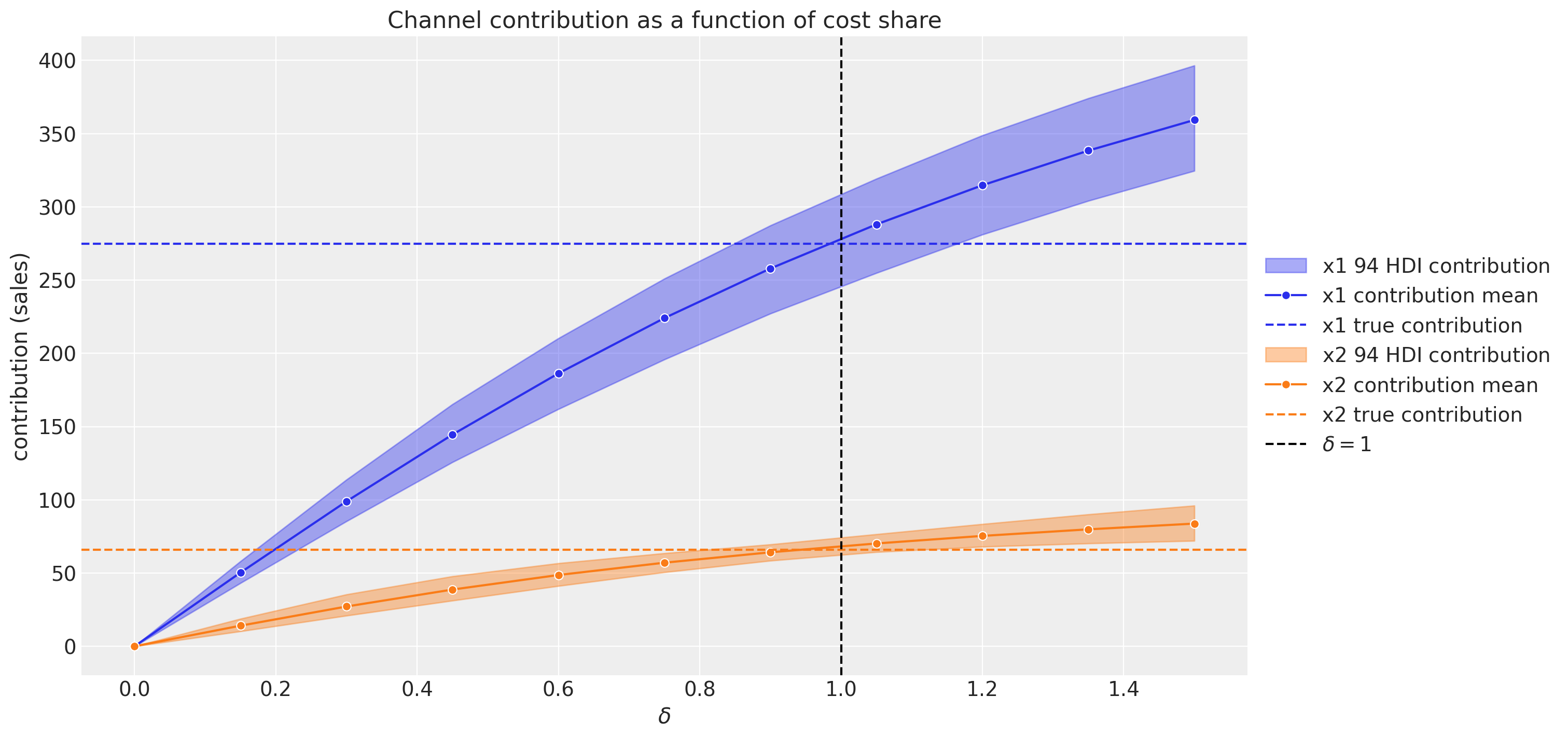

We want to understand the contribution of channels \(x_1\) and \(x_2\) spend into the target variable sales.

MMM Structure

Media Contribution Estimation

Budget Optimization

See pymc-marketing, Issue 259

PyMC-Marketing

Bayesian marketing toolbox in PyMC. Media Mix (MMM), customer lifetime value (CLV), buy-till-you-die (BTYD) models and more.

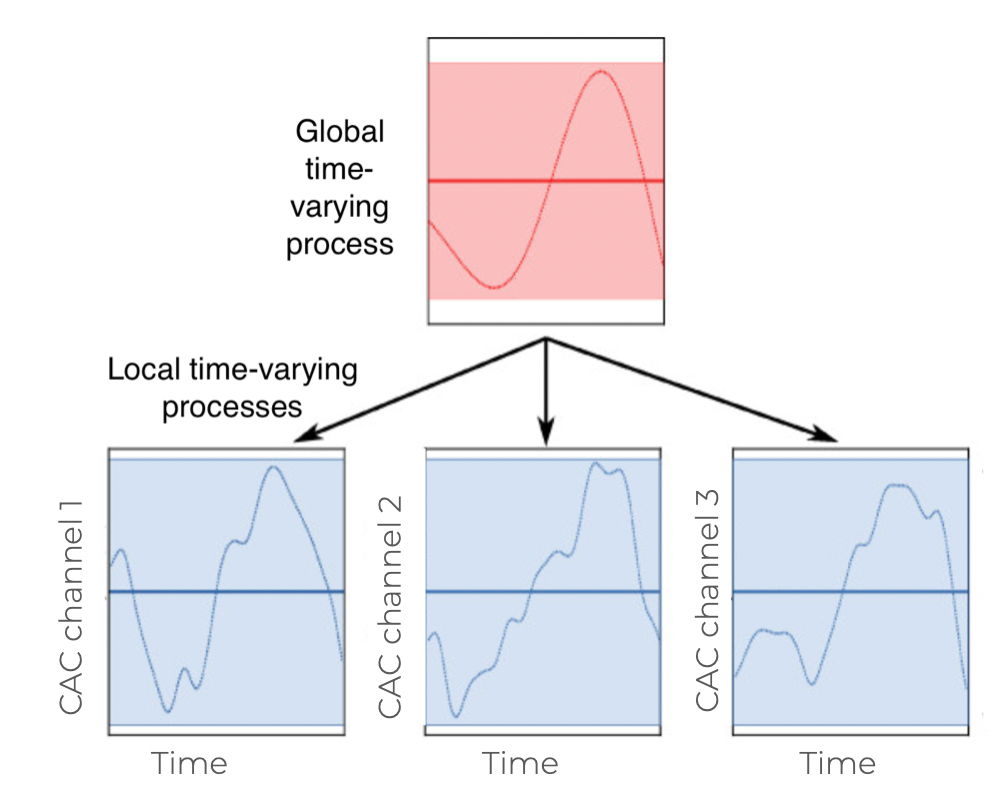

PyMC-Marketing - More MMM Flavours

Very ambitious plans! E.g. Time-varying coefficients through hierarchical Gaussian Processes

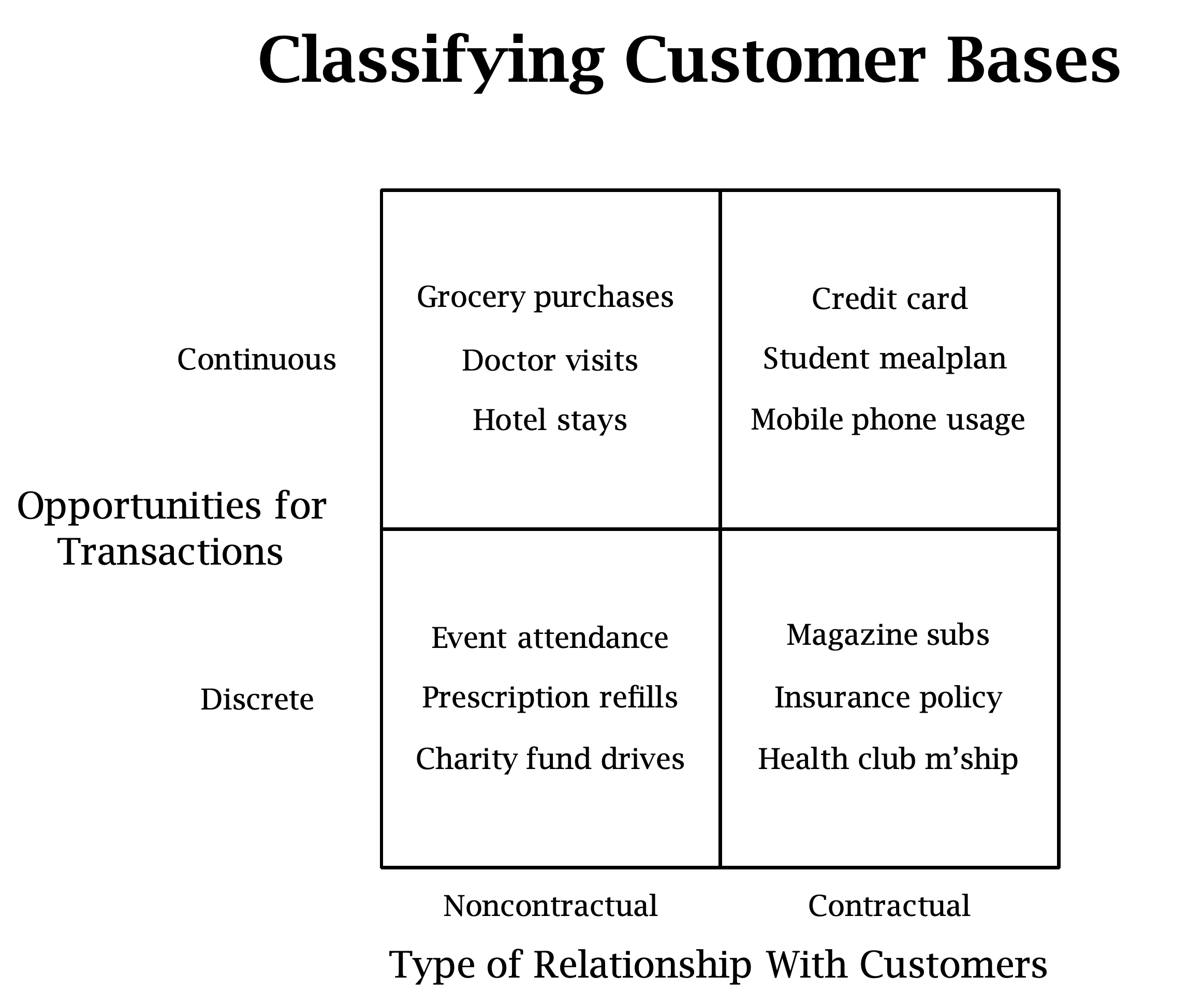

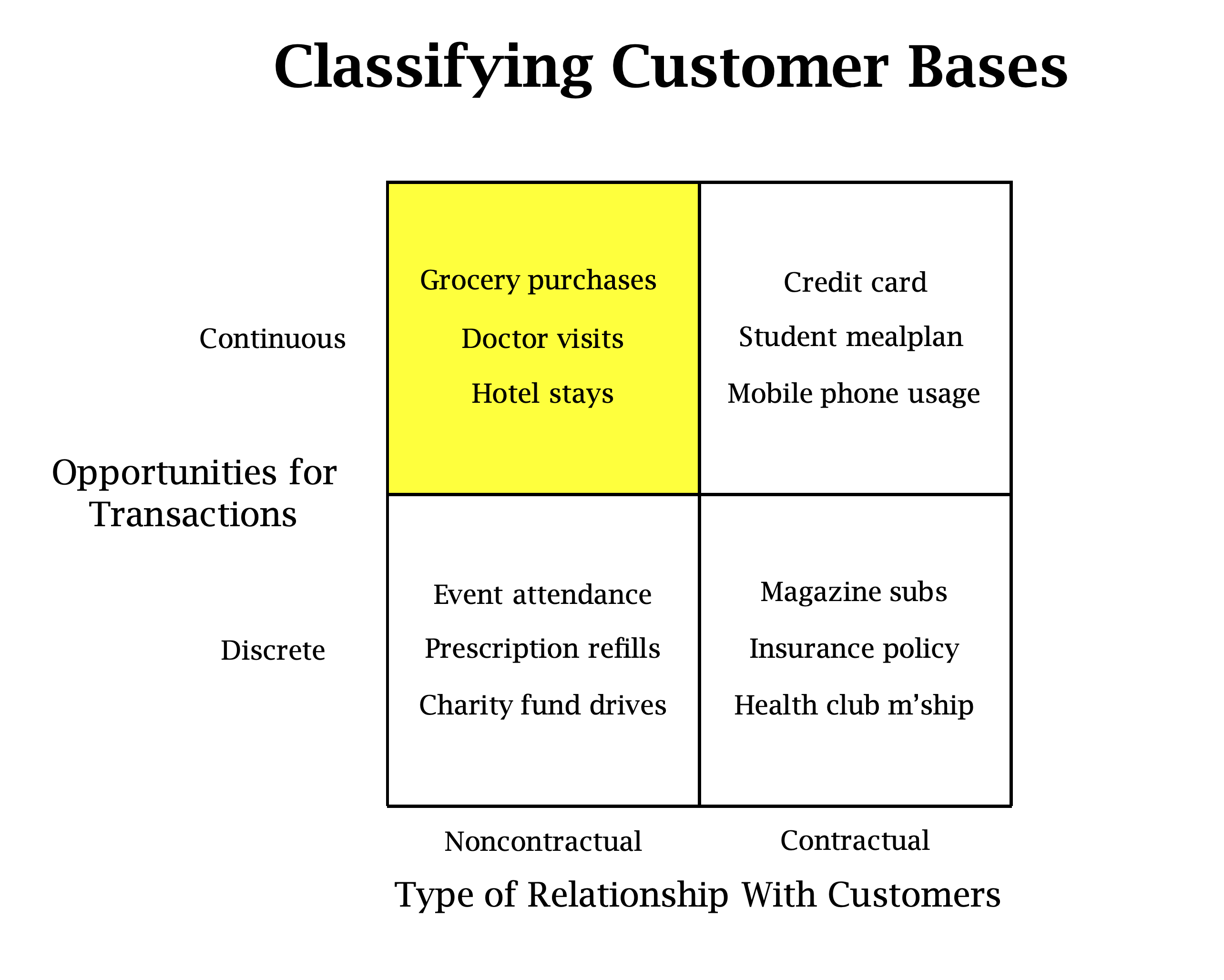

Customer Lifetime Value (CLV)

Continuous Non-Contractractual CLV

frequency: Number of repeat purchases the customer has made.T: Age of the customer in whatever time units chosen.recency: Age of the customer when they made their most recent purchases.

CLV Estimation Strategy

%%{init: {"theme": "dark", "themeVariables": {"fontSize": "48px"}, "flowchart":{"htmlLabels":false}}}%%

flowchart LR

Recency("Recency") --> BGNBD(["BG/NBD"])

T("T") --> BGNBD

Frequency("Frequency") --> BGNBD

Recency("Recency") --> GammaGamma(["Gamma-Gamma"])

T --> GammaGamma

Frequency("Frequency") --> GammaGamma

MonetaryValue("Monetary Value") --> GammaGamma

BGNBD --> ProbabilityAlive("Probability Alive")

BGNBD --> PurchasePrediction("Purchase Prediction")

GammaGamma --> MonetaryValuePrediction("Monetary Value Prediction")

PurchasePrediction --> CLV(("CLV"))

MonetaryValuePrediction --> CLV

style BGNBD fill:#ff3660

style GammaGamma fill:#ff3660

style ProbabilityAlive fill:#1790D0

style PurchasePrediction fill:#1790D0

style MonetaryValuePrediction fill:#1790D0

style CLV fill:#0bb09d

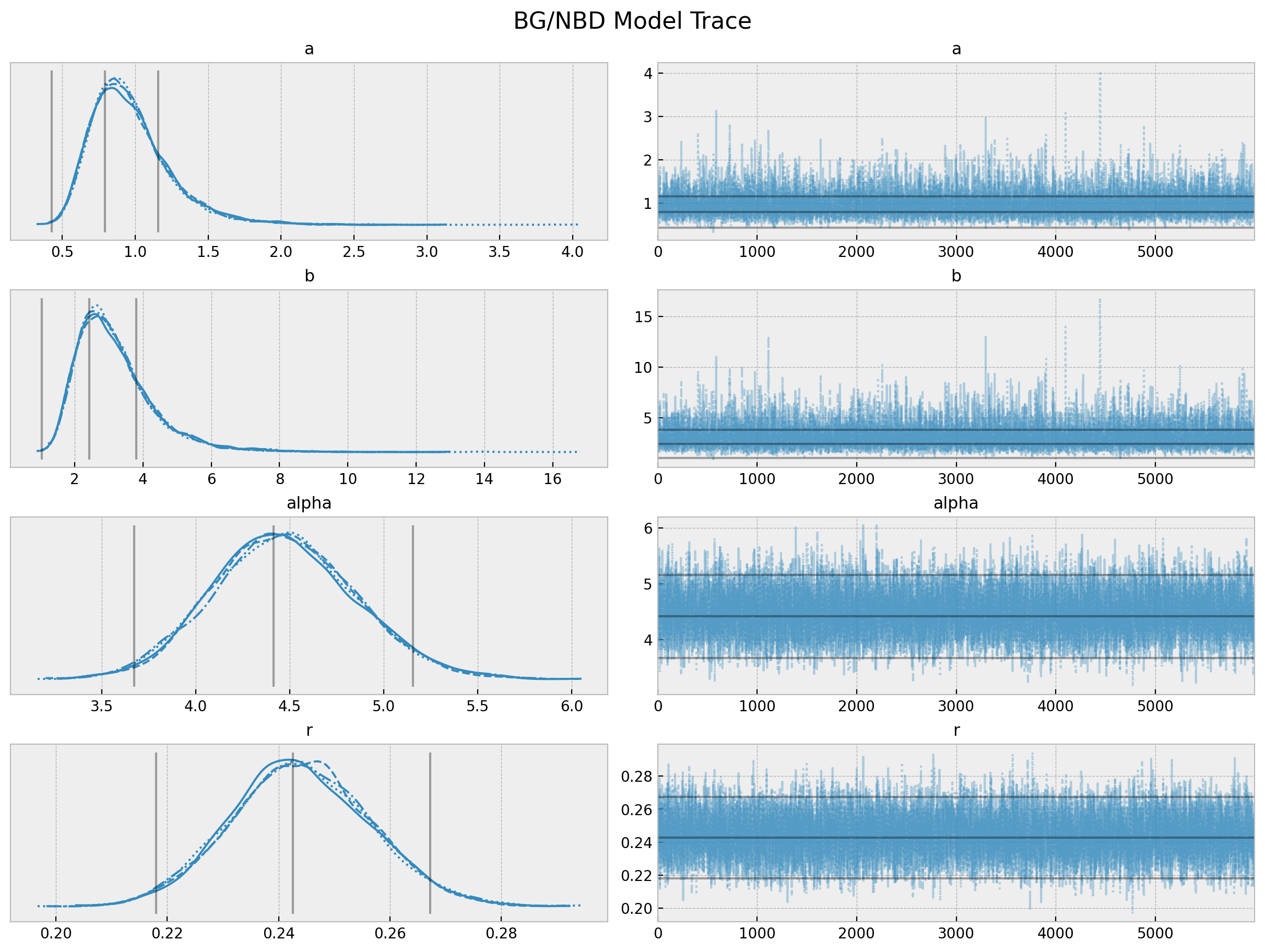

BG/NBD Assumptions

While active, the time between transactions is distributed exponentially with transaction rate, i.e.,

\[f(t_{j}|t_{j-1}; \lambda) = \lambda \exp(-\lambda (t_{j} - t_{j - 1})), \quad t_{j} \geq t_{j - 1} \geq 0\]

Heterogeneity in \(\lambda\) follows a gamma distribution with pdf

\[f(\lambda|r, \alpha) = \frac{\alpha^{r}\lambda^{r - 1}\exp(-\lambda \alpha)}{\Gamma(r)}, \quad \lambda > 0\]

After any transaction, a customer becomes inactive with probability \(p\).

Heterogeneity in \(p\) follows a beta distribution with pdf

\[f(p|a, b) = \frac{\Gamma(a + b)}{\Gamma(a) \Gamma(b)} p^{a - 1}(1 - p)^{b - 1}, \quad 0 \leq p \leq 1\]

The transaction rate \(\lambda\) and the dropout probability \(p\) vary independently across customers.

BG/NBD - Parameter Estimation

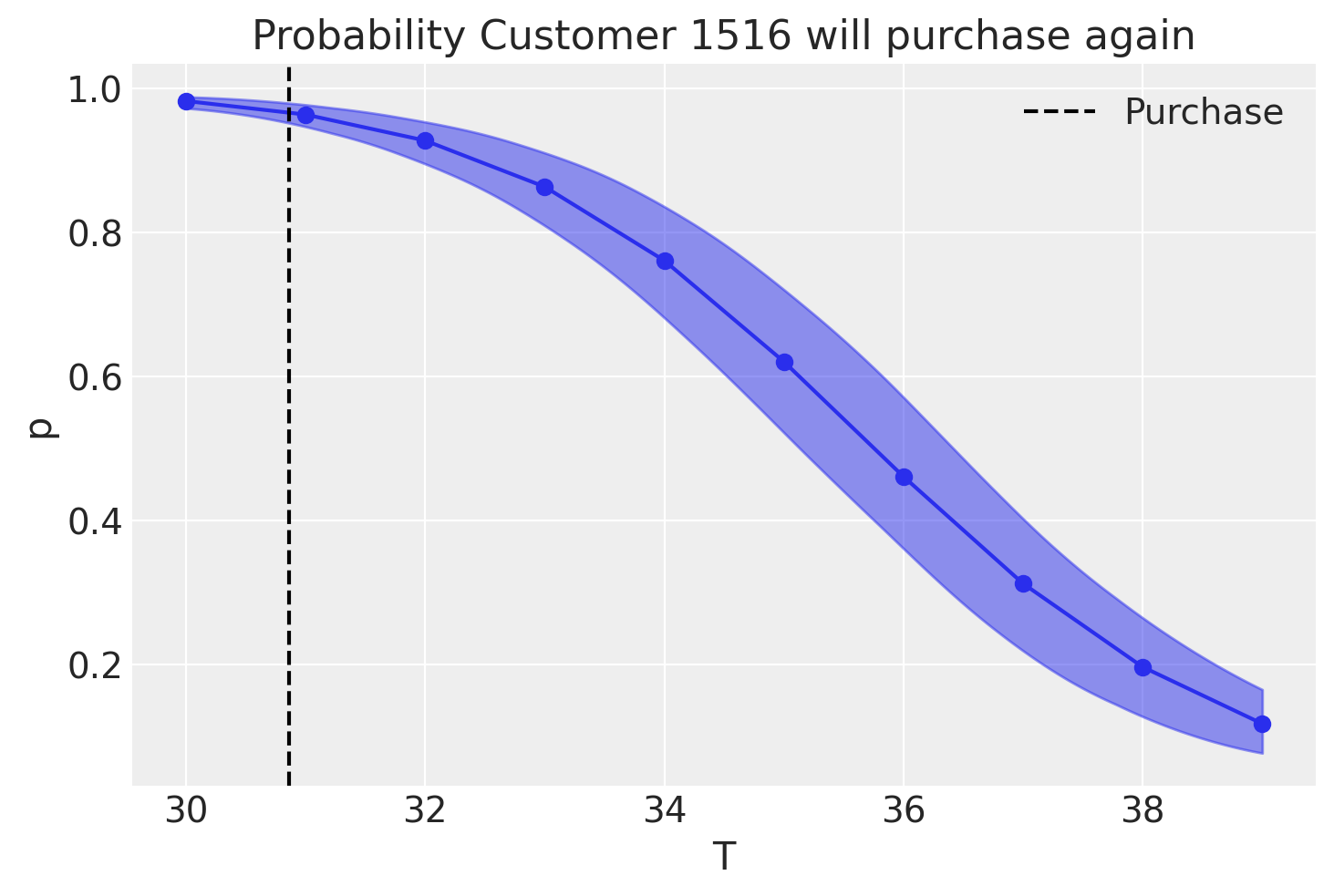

BG/NBD - Probability of Alive

Gamma-Gamma Model

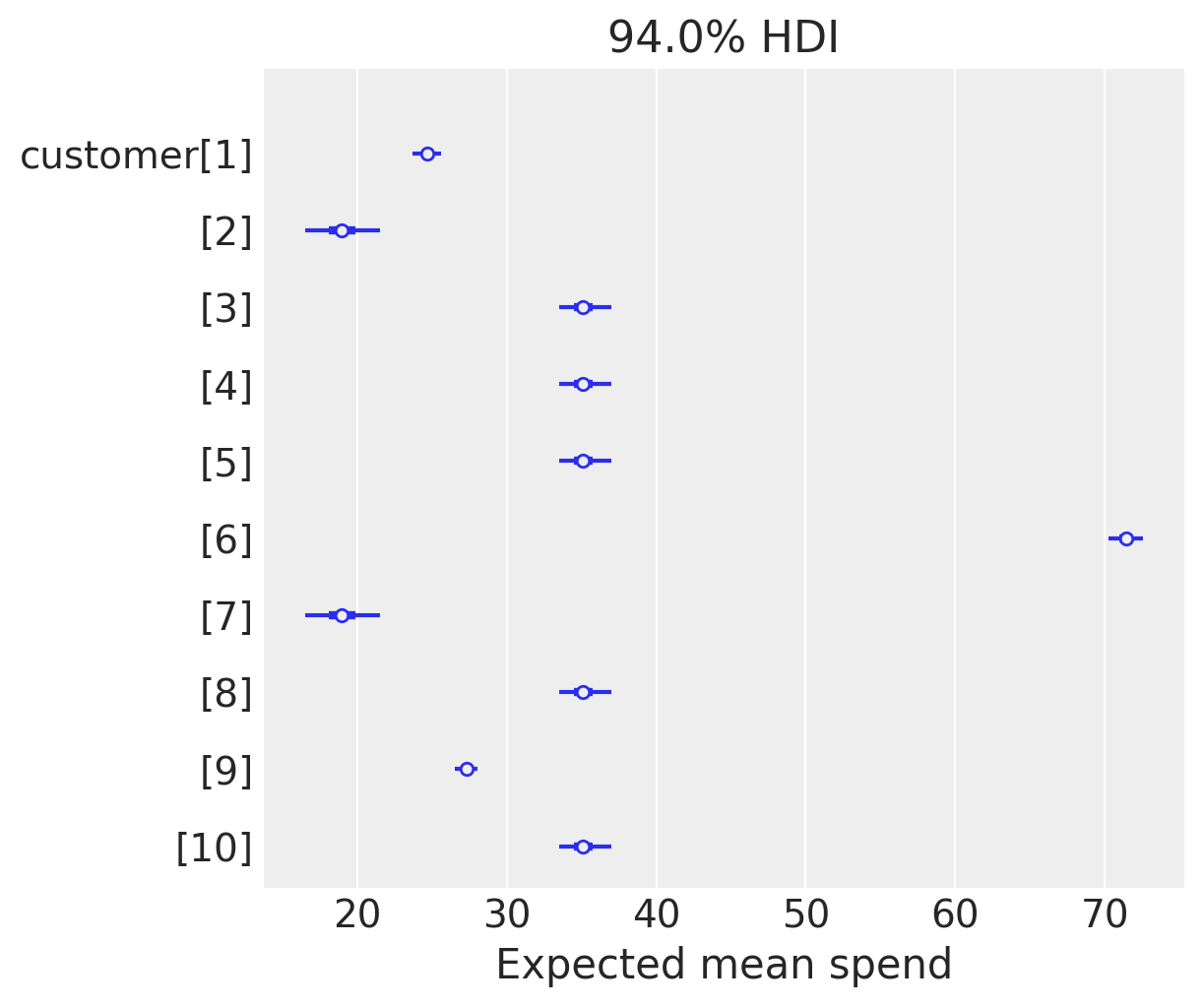

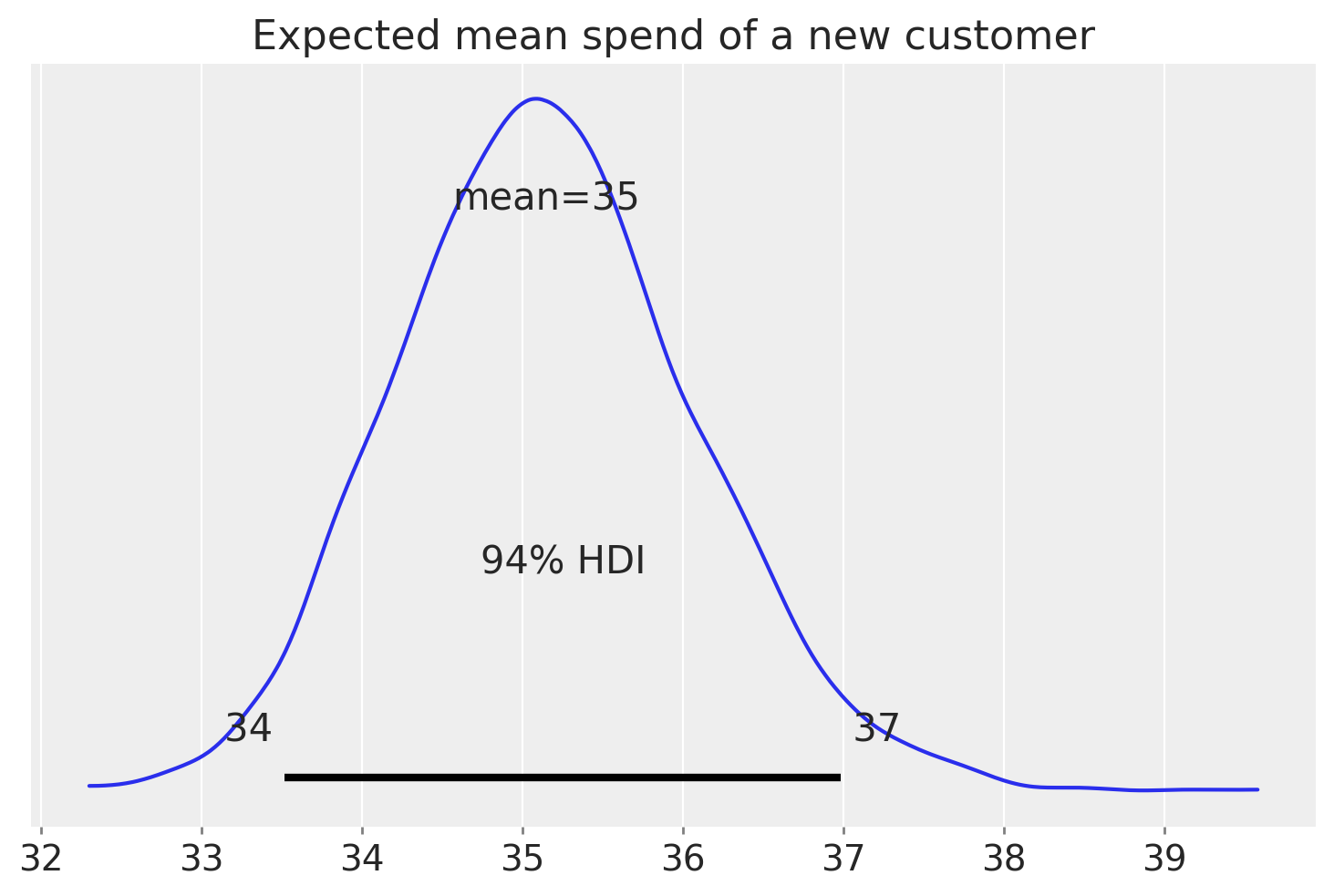

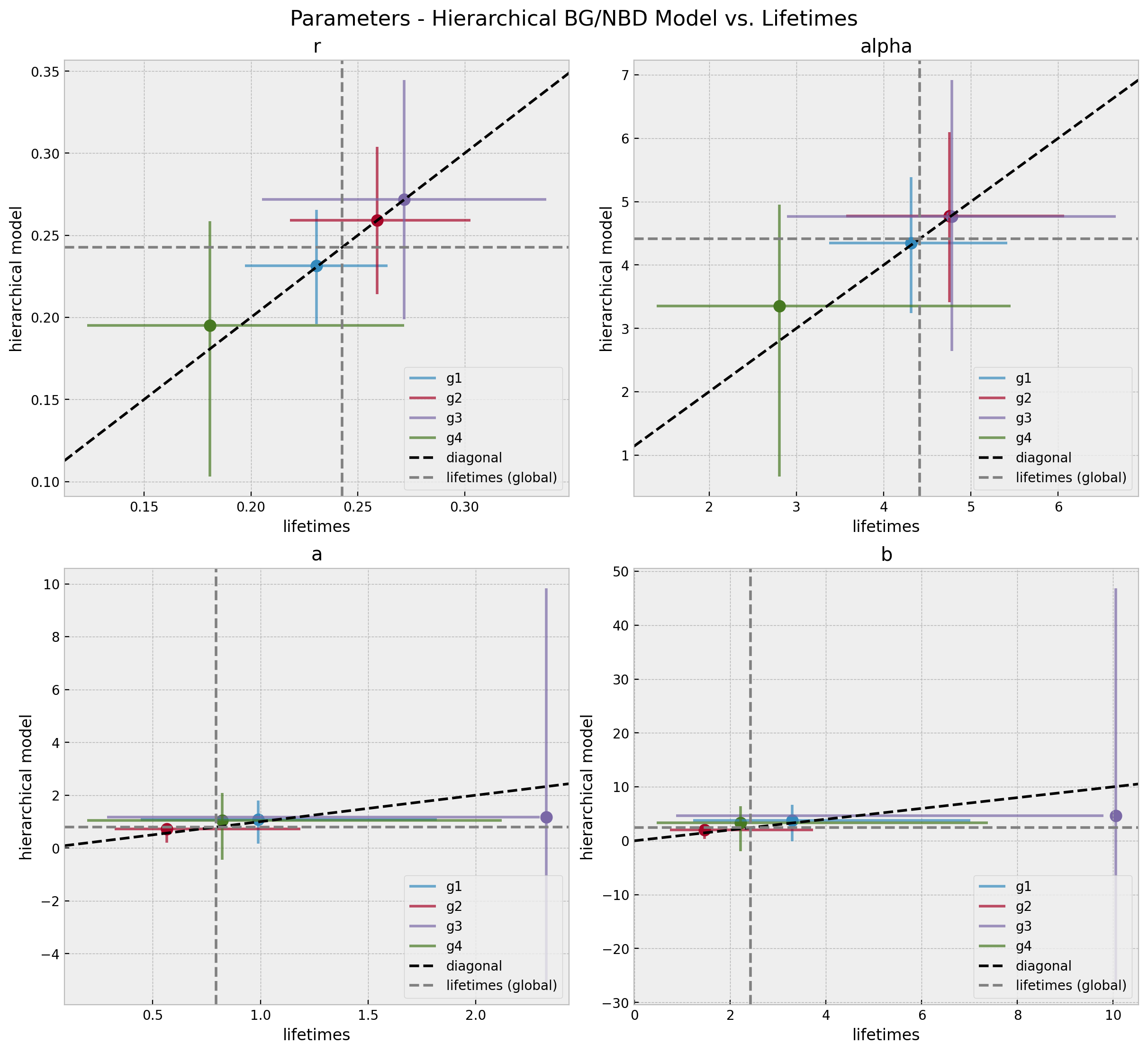

BG/NBD - Hierarchical Models

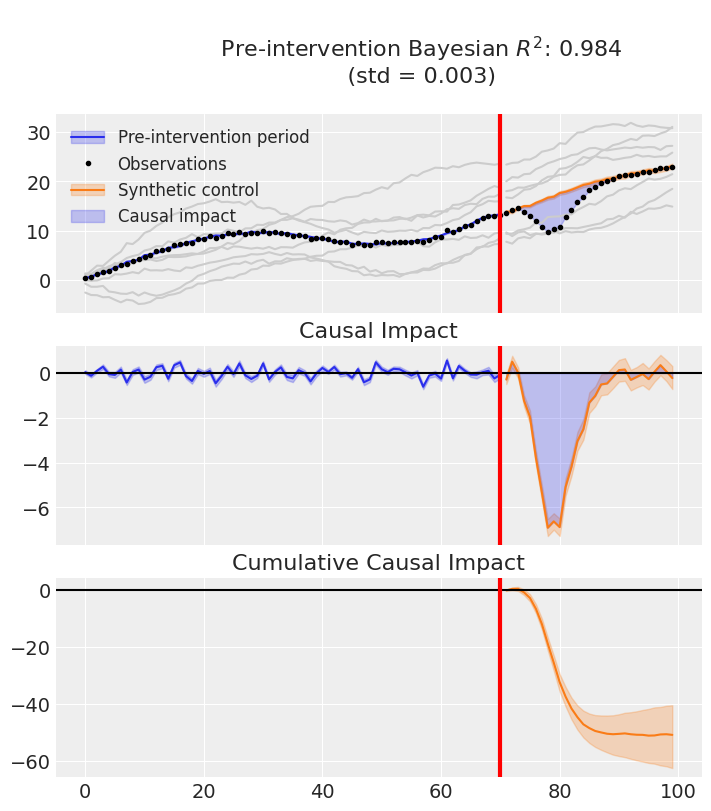

Causal Inference

Synthetic Control

Causal Inference

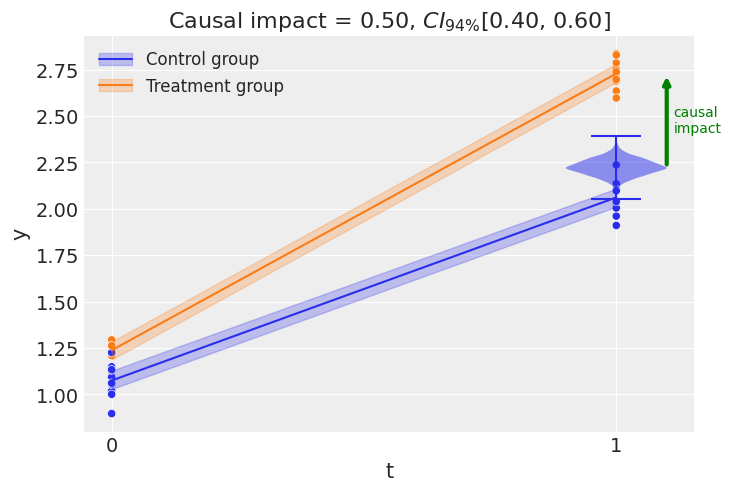

Difference-in-Differences

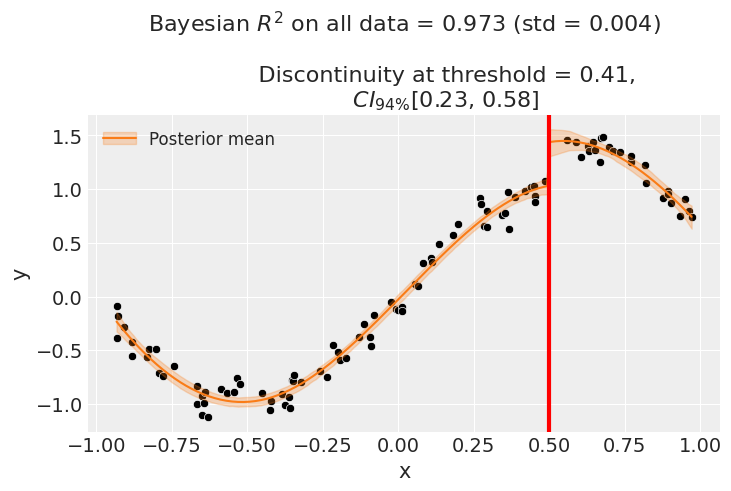

Regression Discontinuity

Instrumental Variables

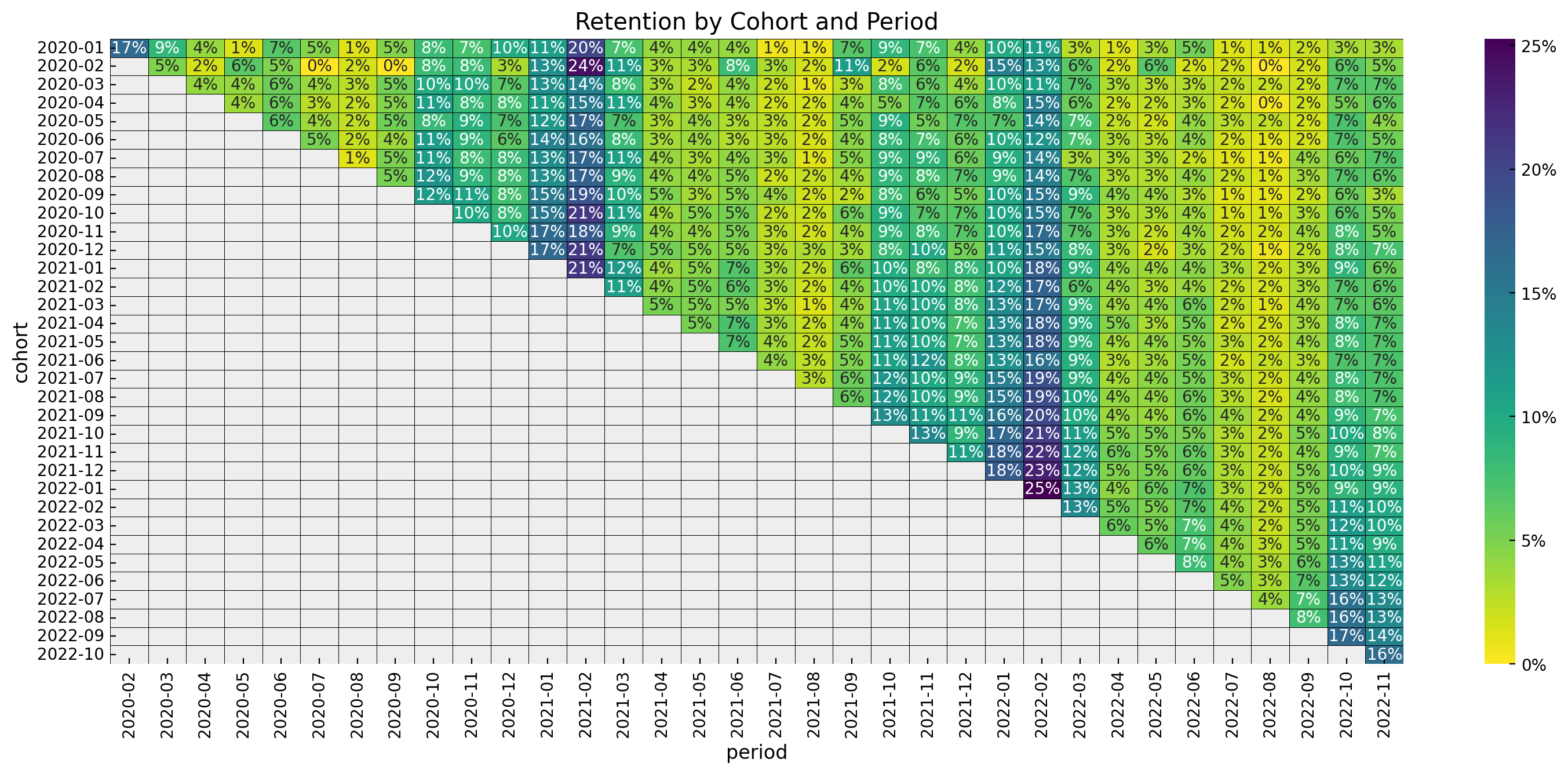

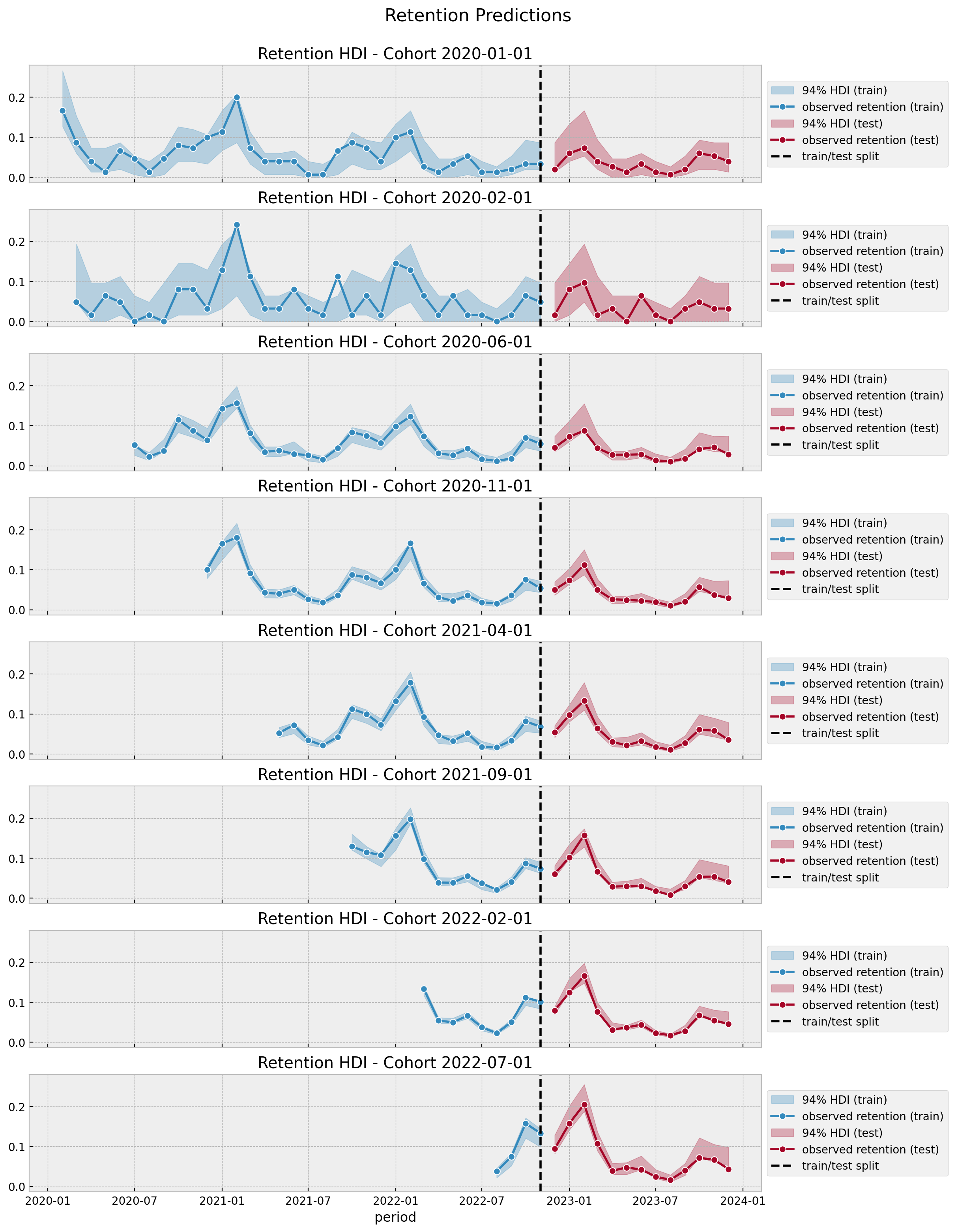

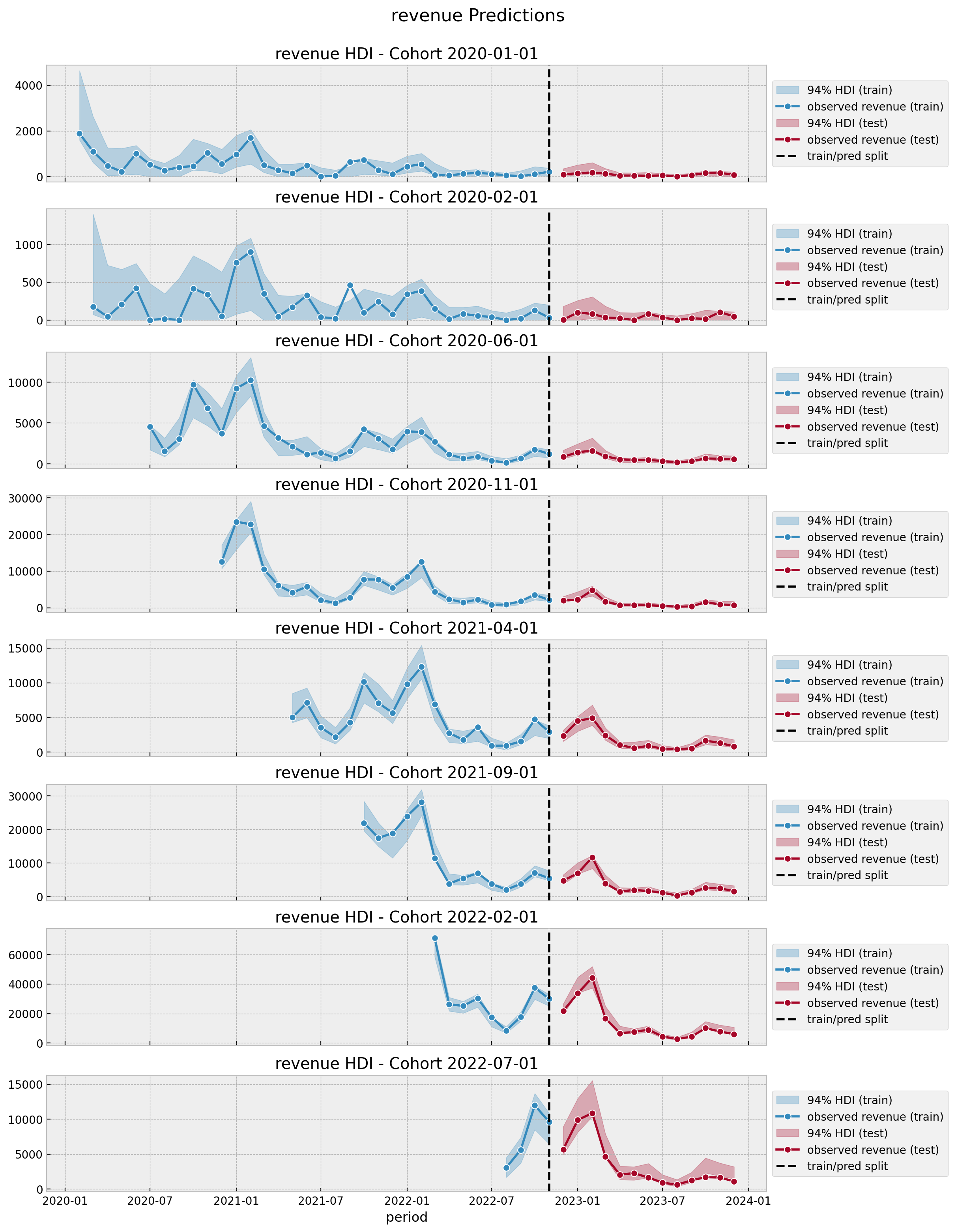

Cohort Revenue-Retention Modeling

- Cohort Age: Age of the cohort in months.

- Age: Age of the cohort with respect to the observation time.

- Month: Month of the observation time (period).

Retention Component

\[\begin{align*} \textrm{logit}(p) & = \text{BART}(\text{cohort age}, \text{age}, \text{month}) \\ N_{\text{active}} & \sim \text{Binomial}(N_{\text{total}}, p) \end{align*}\]

Revenue Component

\[\begin{align*} \log(\lambda) = \: (& \text{intercept} \\ & + \beta_{\text{cohort age}} \text{cohort age} \\ & + \beta_{\text{age}} \text{age} \\ & + \beta_{\text{cohort age} \times \text{age}} \text{cohort age} \times \text{age}) \\ \text{Revenue} & \sim \text{Gamma}(N_{\text{active}}, \lambda) \end{align*}\]

Cohot Revenue-Retention Model

mu = pmb.BART(name="mu", X=x, Y=train_retention_logit, m=50, dims="obs")

p = pm.Deterministic(name="p", var=pm.math.invlogit(mu), dims="obs")

lam_log = pm.Deterministic(

name="lam_log",

var=intercept

+ b_age_scaled * age_scaled

+ b_cohort_age_scaled * cohort_age_scaled

+ b_age_cohort_age_interaction * age_scaled * cohort_age_scaled,

dims="obs",

)

lam = pm.Deterministic(name="lam", var=pm.math.exp(lam_log), dims="obs")

n_active_users_estimated = pm.Binomial(

name="n_active_users_estimated",

n=n_users,

p=p,

observed=n_active_users,

dims="obs",

)

x = pm.Gamma(

name="revenue_estimated",

alpha=n_active_users_estimated + eps,

beta=lam,

observed=revenue,

dims="obs",

)Cohort Revenue-Retention Model

Revenue-Retention - Predictions

References

Media Mix Models

Bayesian Methods for Media Mix Modeling with Carryover and Shape Effects

PyMC bayesian model details: Media Effect Estimation with PyMC: Adstock, Saturation & Diminishing Returns

pymc-marketing: Bayesian marketing toolbox in PyMC. Media Mix (MMM), customer lifetime value (CLV), buy-till-you-die (BTYD) models and more.Bayesian Media Mix Models: Modelling changes in marketing effectiveness over time, by PyMC Labs

Customer Lifetime Value

References

Geo-Experimentaton

Causal Inference

CausalPy: A Python package for causal inference in quasi-experimental settingsExperimentation, Non-Compliance and Instrumental Variables with PyMC

Revenue-Retention Modeling

Thank you!

Connect with PyMC Labs

🔗 Learn more about pymc-marketing:

- 🐙 GitHub: https://github.com/pymc-labs/pymc-marketing

- 📝 Documentation: https://www.pymc-marketing.io/en/stable/

🔗 Connecting with PyMC Labs:

- 👥 LinkedIn: https://www.linkedin.com/company/pymc-labs/

- 🐦 Twitter: https://twitter.com/pymc_labs

- 🎥 YouTube: https://www.youtube.com/PyMCLabs

- 🤝 Meetup: https://www.meetup.com/pymc-labs-online-meetup/