%%{init: {"theme": "white", "themeVariables": {"fontSize": "48px"}, "flowchart":{"htmlLabels":false}}}%%

flowchart TD

N[Number of Users] --> N_active[Number of Active Users]

N_active --> Retention[Retention]

Retention --> Revenue[Revenue]

Cohort Revenue & Retention Analysis: A Bayesian Approach

PyData Berlin - July 2023

Mathematician & Data Scientist

Outline

Introduction

Bottom-Up Approaches

2.1 Shifted Beta Geometric (Contractual)

2.2 BG/NBD Model (Non-Contractual)

Simple Cohort Retention Model (GLM)

Retention Model with BART

Cohort Revenue-Retention Model

Applications

References

Business Problem

Example

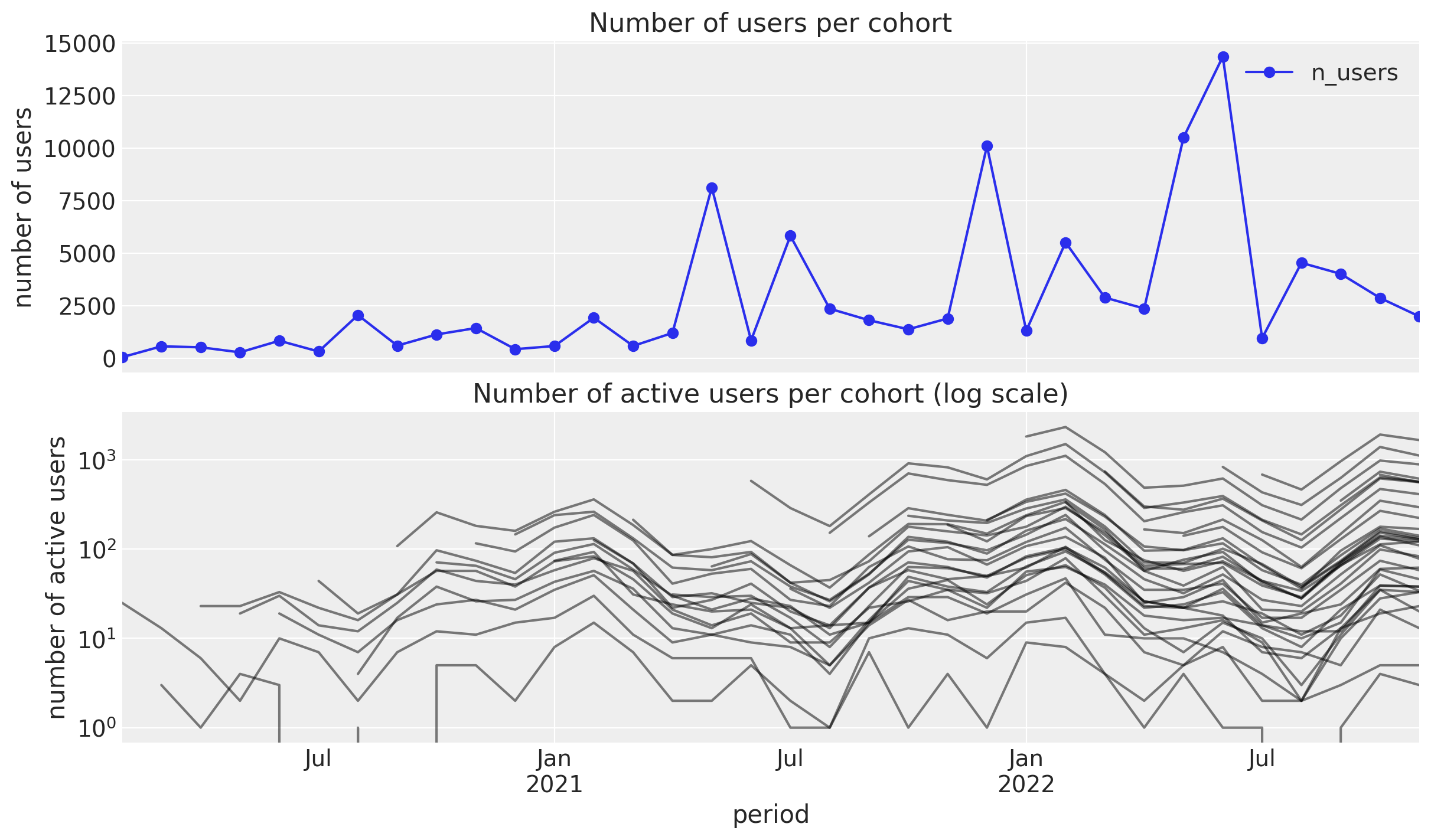

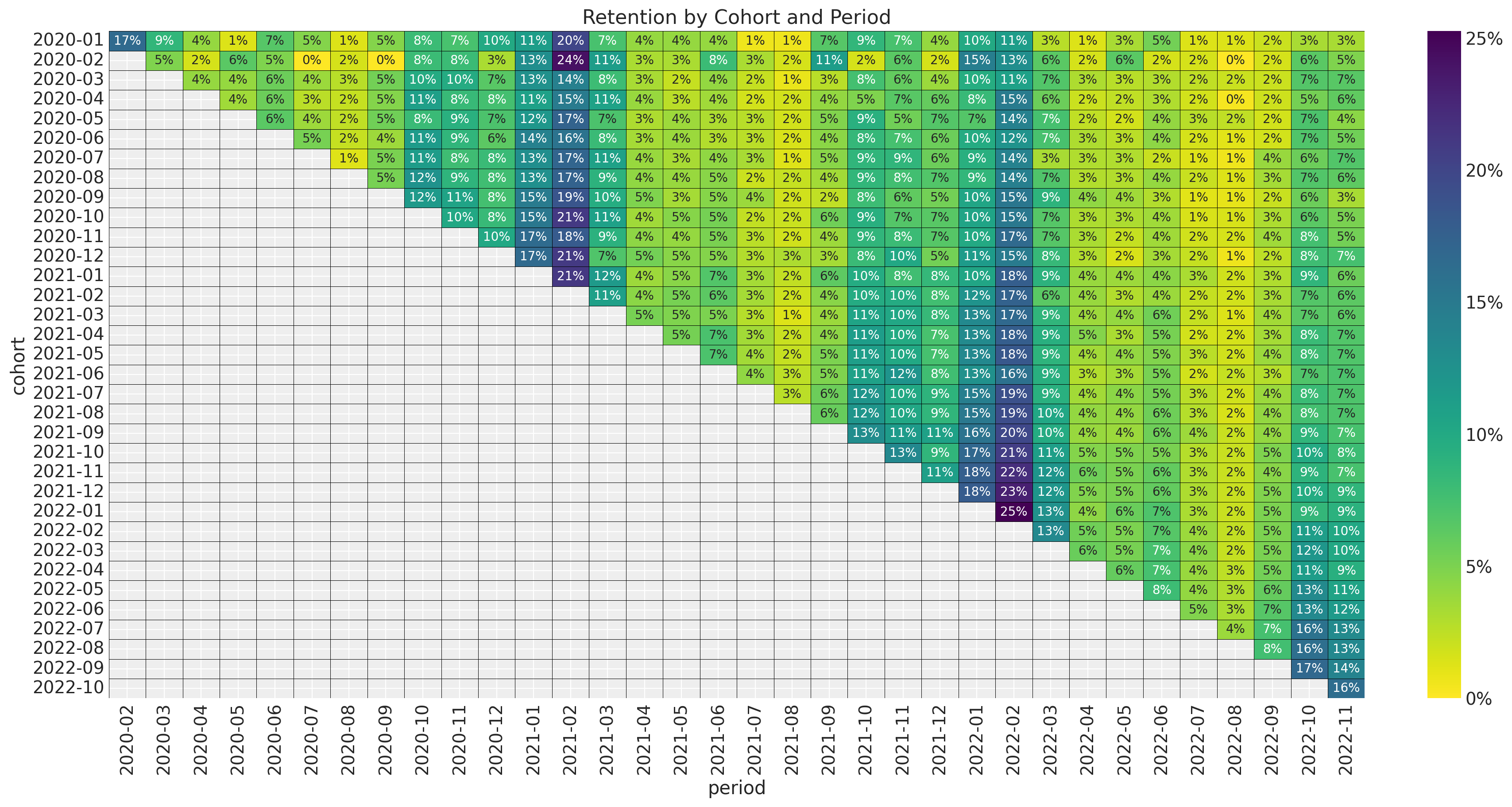

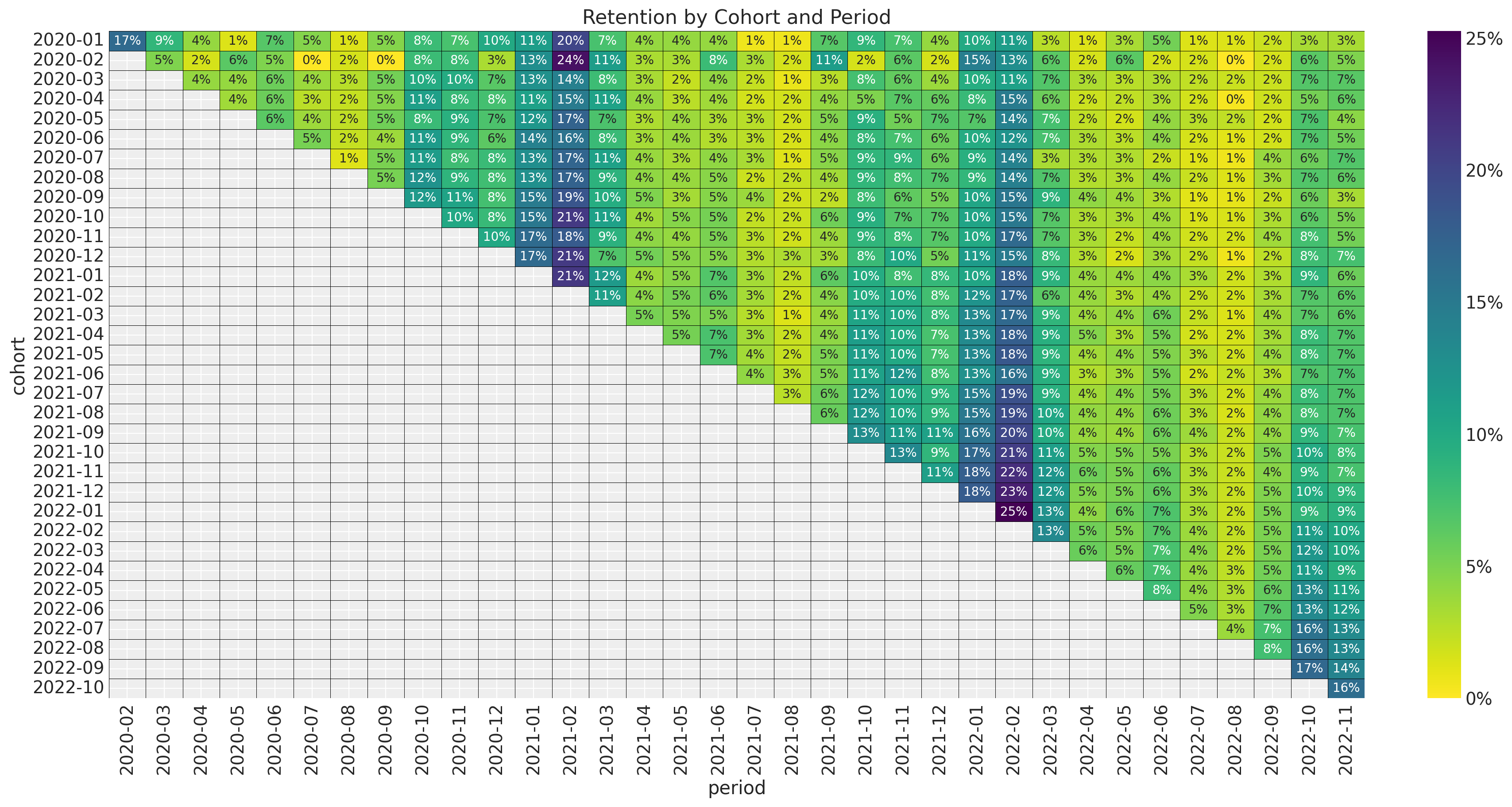

During January \(2020\), \(100\) users signed up for a service (cohort).

In February \(2020\), there were \(17\) users from the \(2020-01\) cohort active (e.g. did at least one purchase). The retention rate is \(17\%\).

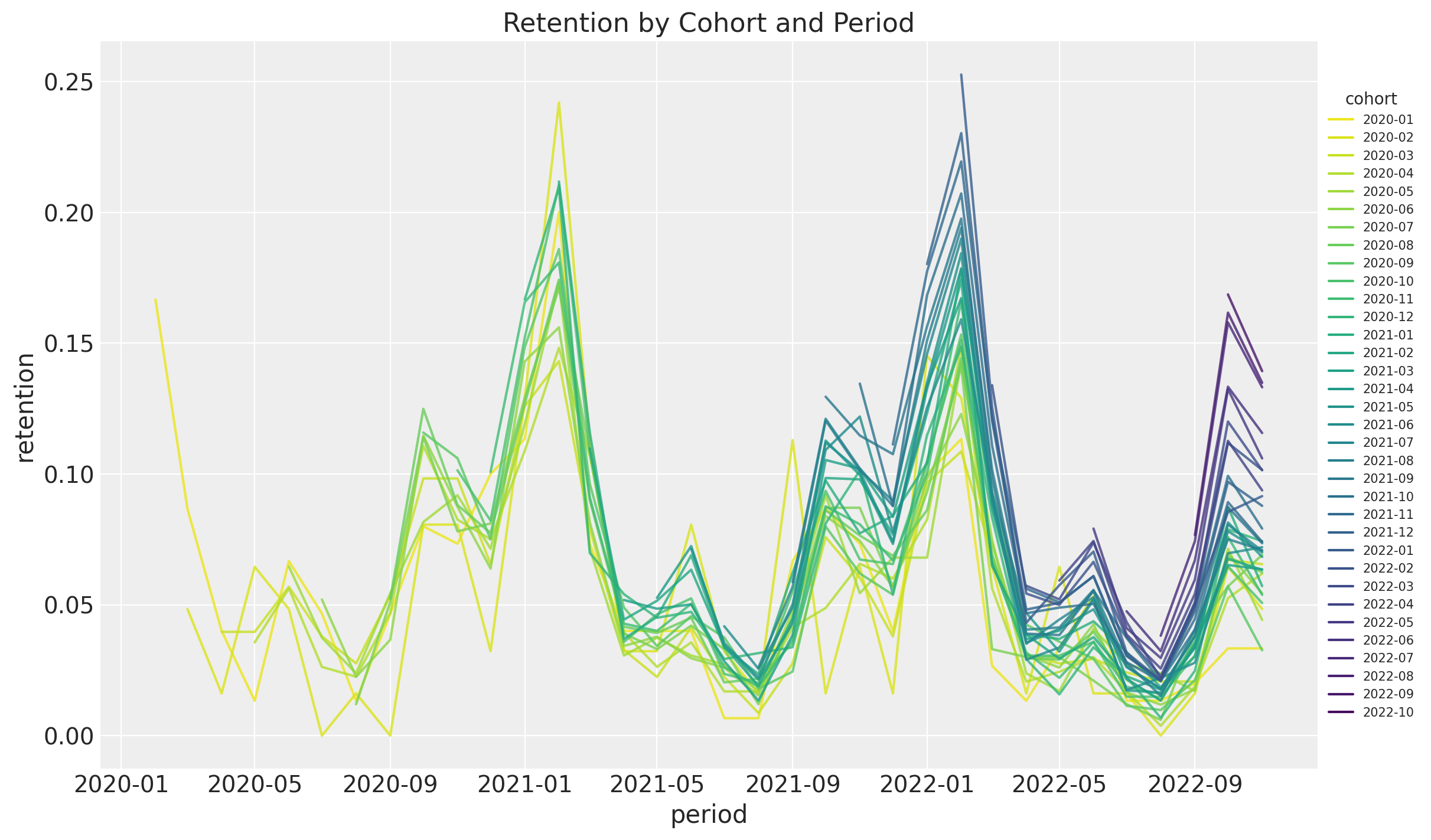

We want to understand and predict how retention develops over time.

The main motivation is to estimate customer lifetime value (CLV).

Number of Active Users

Retention Matrix

Bottom-Up Approaches

Predict the retention of each user individually and then aggregate the results.

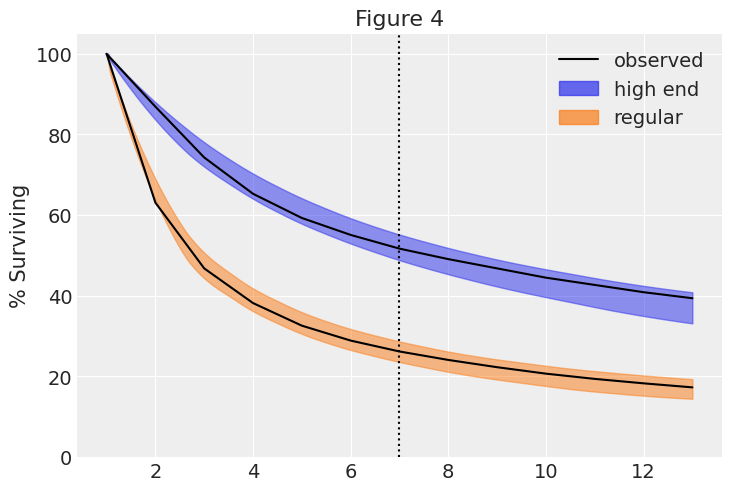

Example: Shifted Beta Geometric (Contractual)

An individual remains a customer of the company with constant retention probability \(1 - \theta\). This is equivalent to assuming that the duration of the customer’s relationship with the company, denoted by the random variable \(T\), is characterized by the (shifted) geometric distribution with probability mass function and survivor function given by

\[f(T=t|\theta) = \theta (1 - \theta)^{t - 1}, \quad t = 1, 2, \ldots\]

\[S(t) = \sum_{j = t}^{\infty} f(T=j|\theta) = (1 - \theta)^{t}, \quad t = 1, 2, \ldots\]

Heterogeneity in \(\theta\) follows a beta distribution \(\theta \sim \text{Beta}(a, b)\).

Shifted Beta Geometric - Survival Function

See pymc-marketing example here.

Bottom-Up Approaches

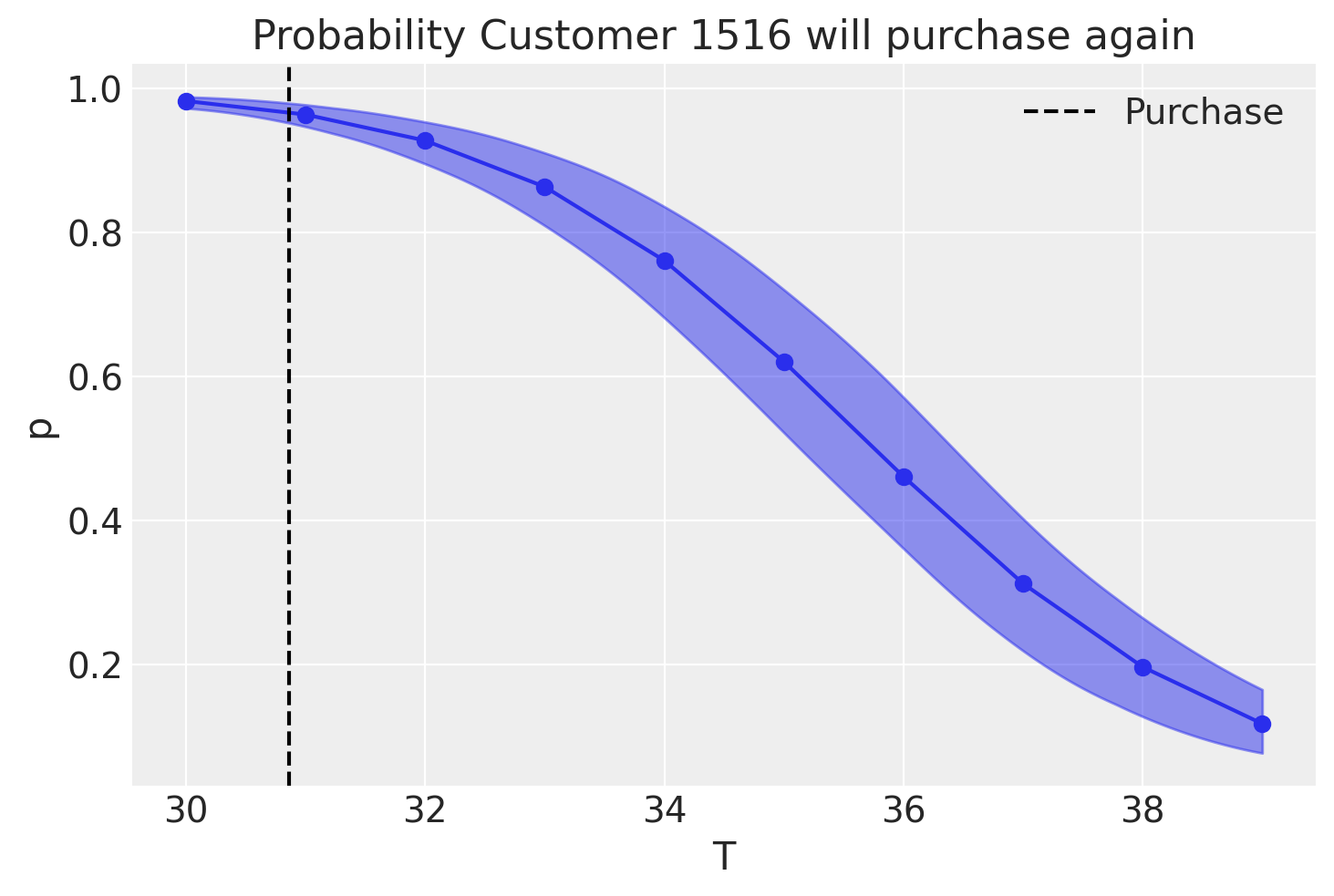

Example: BG/NBD Model (Non-Contractual)

While active, the time between transactions is distributed exponentially with transaction rate, i.e.,

\[f(t_{j}|t_{j-1}; \lambda) = \lambda \exp(-\lambda (t_{j} - t_{j - 1})), \quad t_{j} \geq t_{j - 1} \geq 0\]

Heterogeneity in \(\lambda\) follows a gamma distribution \(\lambda \sim \text{Gamma}(r, \alpha)\).

After any transaction, a customer becomes inactive with probability \(p\).

Heterogeneity in \(p\) follows a beta distribution \(p \sim \text{Beta}(a, b)\).

The transaction rate \(\lambda\) and the dropout probability \(p\) vary independently across customers.

BG/NBD - Probability of Alive

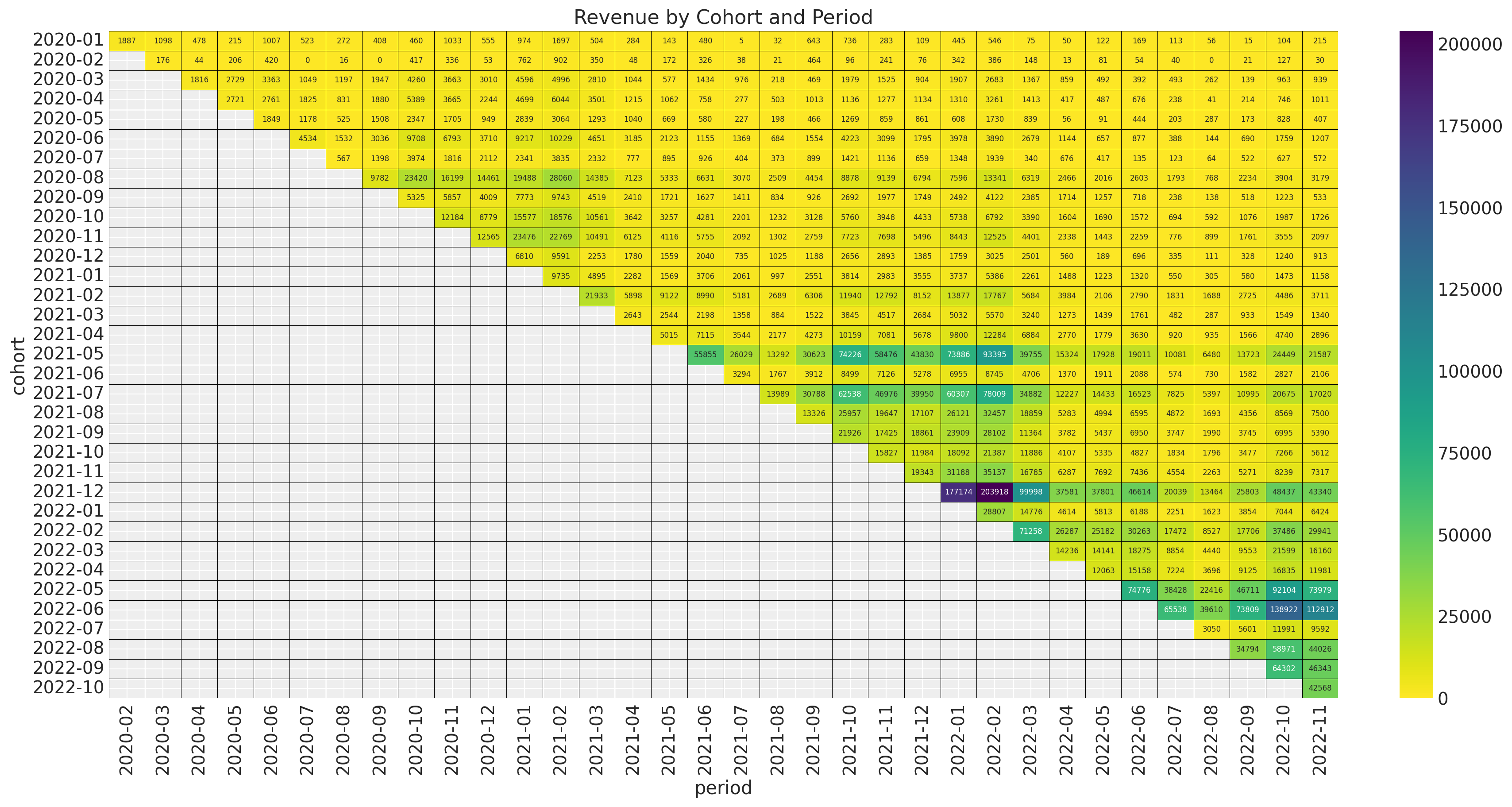

Retention Matrix

- Cohort Age: Age of the cohort in months.

- Age: Age of the cohort with respect to the observation time.

- Month: Month of the observation time (period).

Retention Over Time (period)

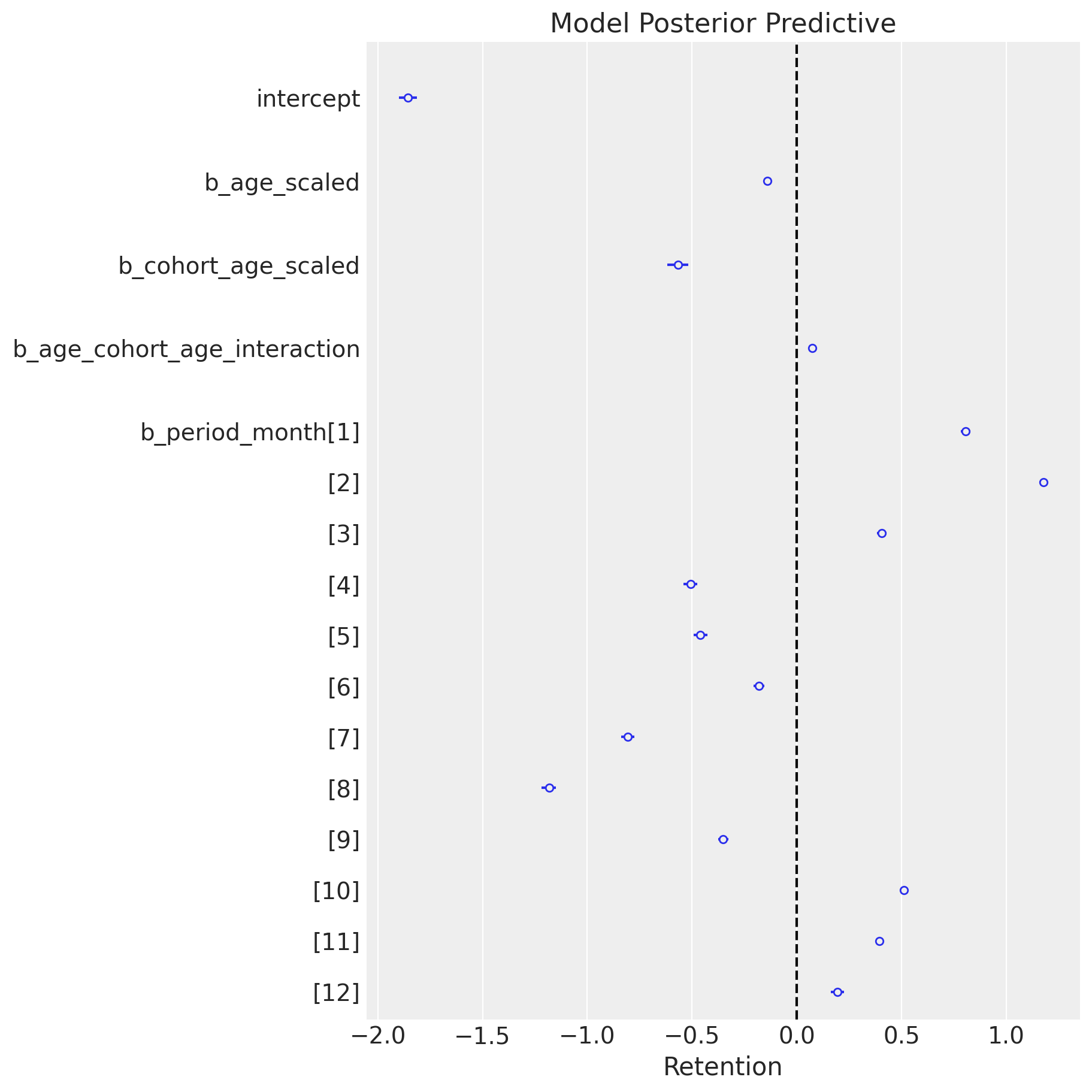

Retention - Generalized Linear Model

\[\begin{align*} N_{\text{active}} \sim & \: \text{Binomial}(N_{\text{total}}, p) \\ \textrm{logit}(p) = & \: ( \text{intercept} \\ & + \beta_{\text{cohort age}} \text{cohort age} \\ & + \beta_{\text{age}} \text{age} \\ & + \beta_{\text{cohort age} \times \text{age}} \text{cohort age} \times \text{age} \\ & + \beta_{\text{seasonality}} \text{seasonality} ) \end{align*}\]

where \(p\) represents the retention and \(\text{logit}: (0, 1) \longrightarrow \mathbb{R}\) is defined by \(\text{logit}(p) = \log\left(\frac{p}{1-p}\right)\).

Retention - GLM in PyMC

Retention - GLM in PyMC

with pm.Model(coords=coords) as model:

# --- Data ---

model.add_coord(name="obs", values=train_obs_idx, mutable=True)

age_scaled = pm.MutableData(

name="age_scaled", value=train_age_scaled, dims="obs"

)

cohort_age_scaled = pm.MutableData(

name="cohort_age_scaled", value=train_cohort_age_scaled, dims="obs"

)

period_month_idx = pm.MutableData(

name="period_month_idx", value=train_period_month_idx, dims="obs"

)

n_users = pm.MutableData(

name="n_users", value=train_n_users, dims="obs"

)

n_active_users = pm.MutableData(

name="n_active_users", value=train_n_active_users, dims="obs"

)

# --- Priors ---

intercept = pm.Normal(name="intercept", mu=0, sigma=1)

b_age_scaled = pm.Normal(name="b_age_scaled", mu=0, sigma=1)

b_cohort_age_scaled = pm.Normal(

name="b_cohort_age_scaled", mu=0, sigma=1

)

b_period_month = pm.ZeroSumNormal(

name="b_period_month", sigma=1, dims="period_month"

)

b_age_cohort_age_interaction = pm.Normal(

name="b_age_cohort_age_interaction", mu=0, sigma=1

)

# --- Parametrization ---

mu = pm.Deterministic(

name="mu",

var=intercept

+ b_age_scaled * age_scaled

+ b_cohort_age_scaled * cohort_age_scaled

+ b_age_cohort_age_interaction * age_scaled * cohort_age_scaled

+ b_period_month[period_month_idx],

dims="obs",

)

p = pm.Deterministic(name="p", var=pm.math.invlogit(mu), dims="obs")

# --- Likelihood ---

pm.Binomial(

name="likelihood",

n=n_users,

p=p,

observed=n_active_users,

dims="obs",

)Posterior Distribution

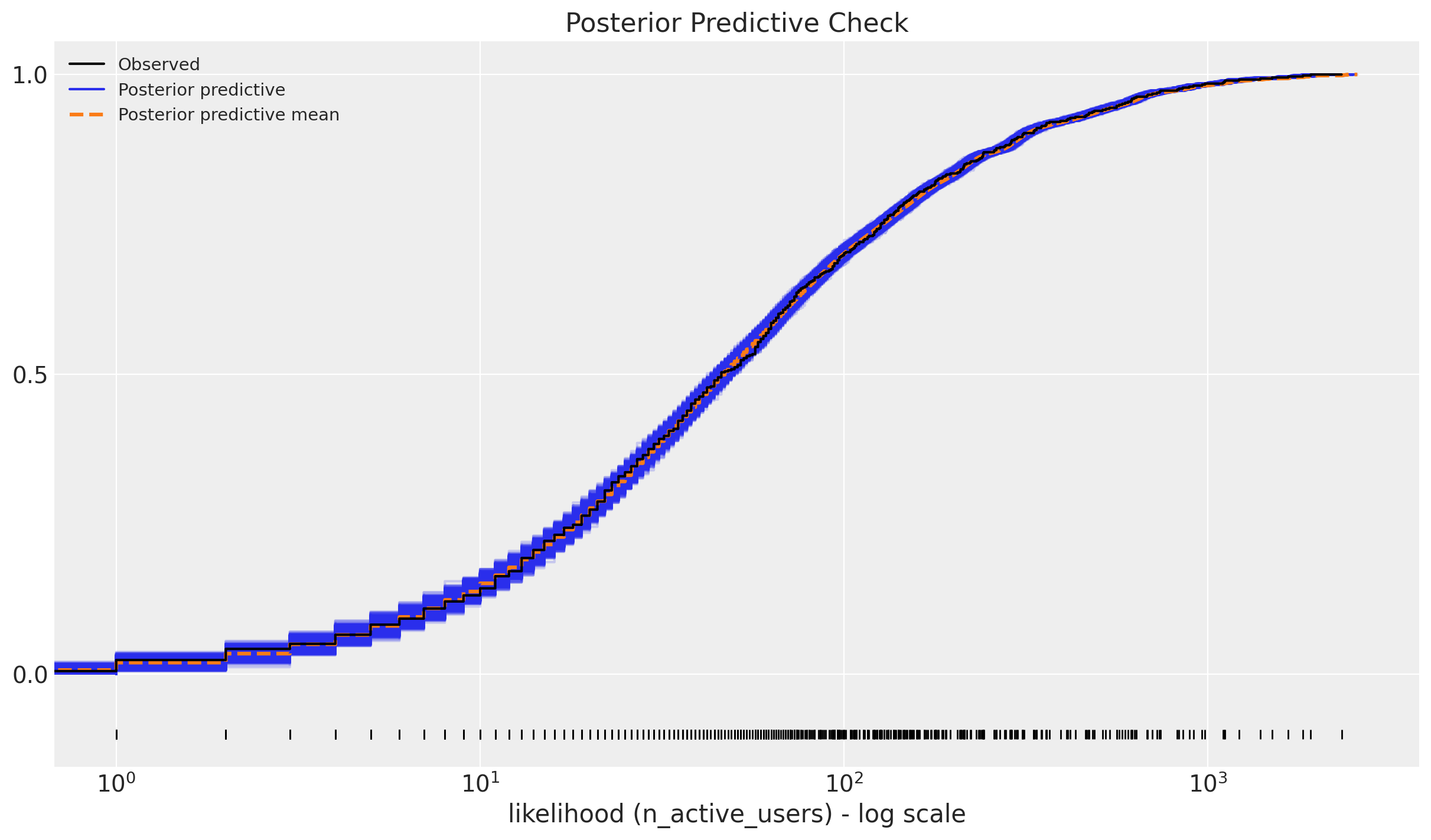

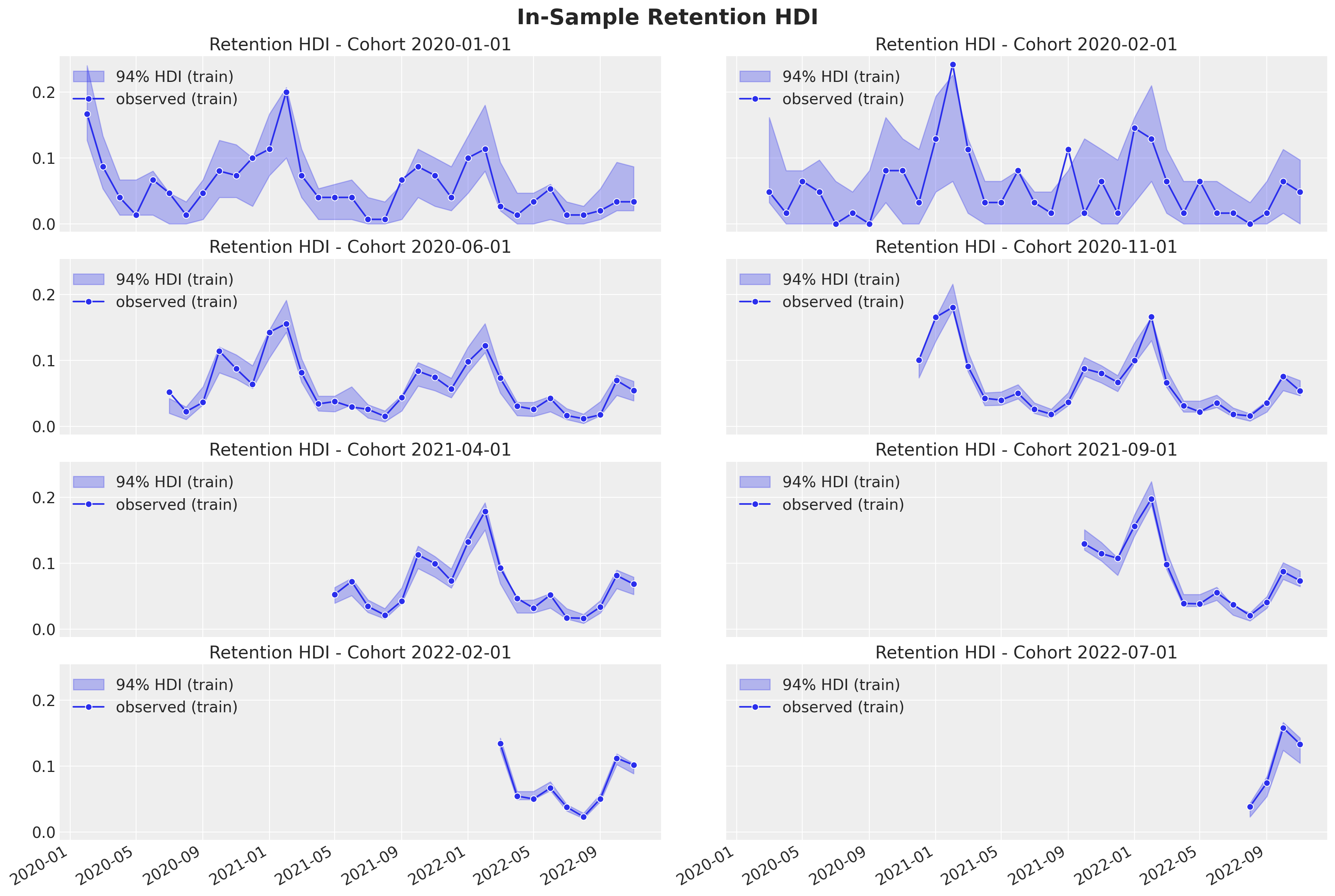

Posterior Predictive Check

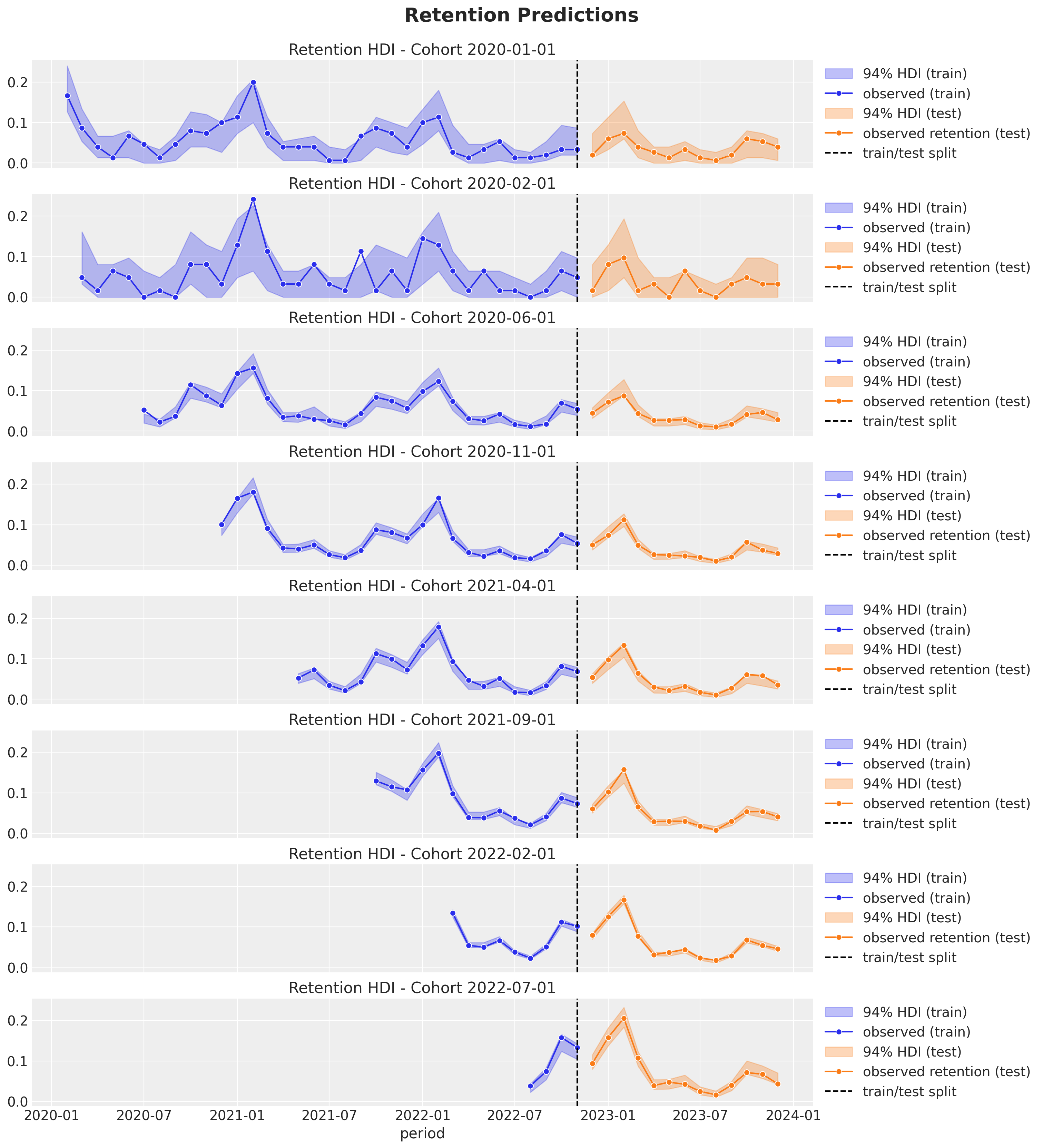

In-Sample Predictions

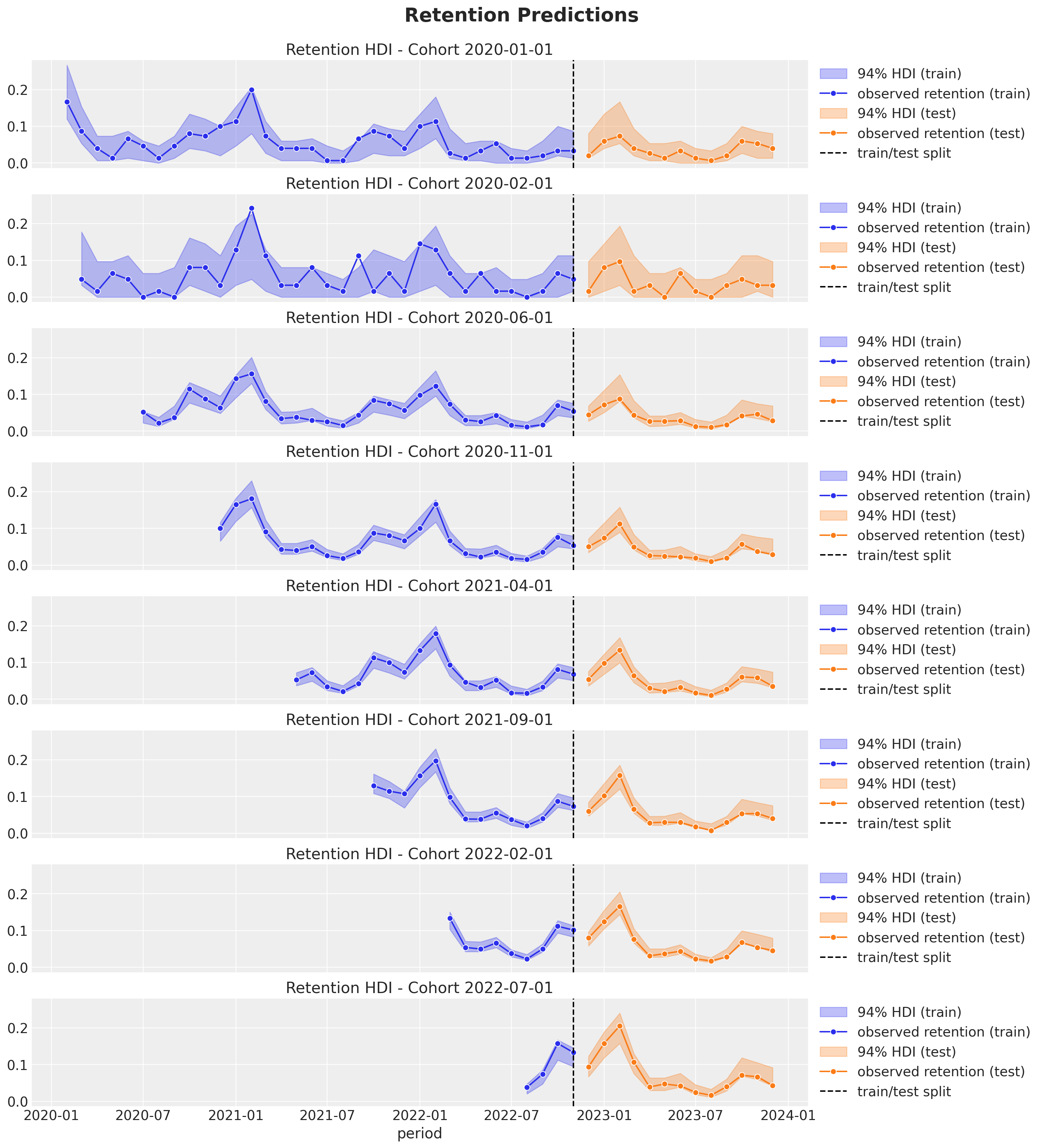

Out-of-Sample Predictions

More Complex Models - Requirements

In many real-world scenarios, the data is more complex and the linear model is not enough. We need a more flexible model that can capture non-linearities and interactions.

We care about uncertainty.

We want to be able to iterate fast.

Interested in out-of-sample predictions.

We want to couple retention modeling with revenue modeling (CLV).

Bayesian Additive Regression Trees

Bayesian “sum-of-trees” model where each tree is constrained by a regularization prior to be a weak learner.

To fit the sum-of-trees model, BART uses PGBART, an inference algorithm based on the particle Gibbs method.

BART depends on the number of trees \(m\in \mathbb{N}\) and prior parameters \(\alpha \in (0, 1)\) and \(\beta \in [0, \infty)\) so that the probability that a node at depth \(d \in \mathbb{N}_{0}\) is nonterminal is \(\alpha(1 + d)^{-\beta}\).

BART is implemented in

pymc-bart.

BART Retention Model

\[\begin{align*} N_{\text{active}} & \sim \text{Binomial}(N_{\text{total}}, p) \\ \textrm{logit}(p) & = \text{BART}(\text{cohort age}, \text{age}, \text{month}) \end{align*}\]

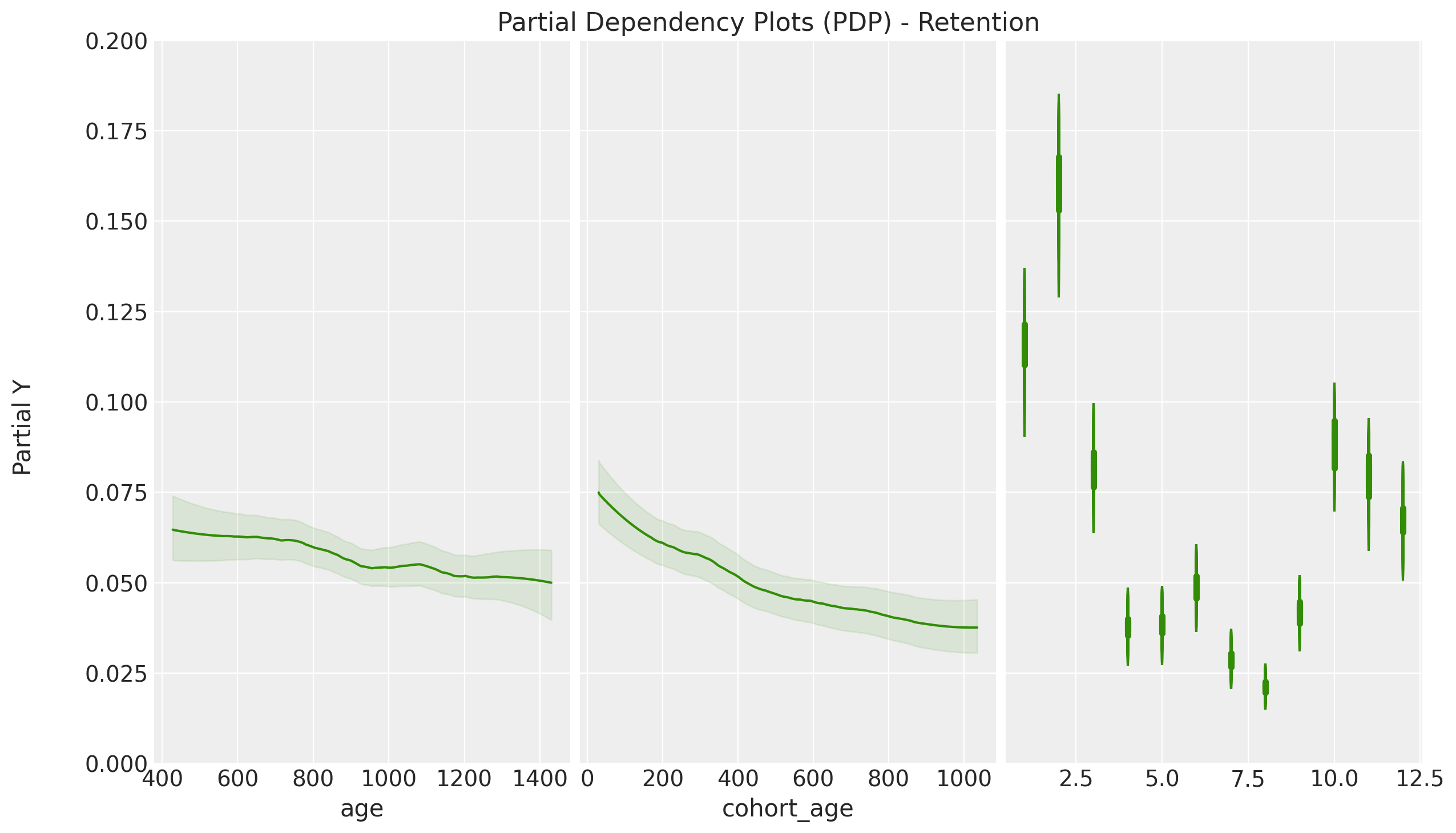

PDP Plot

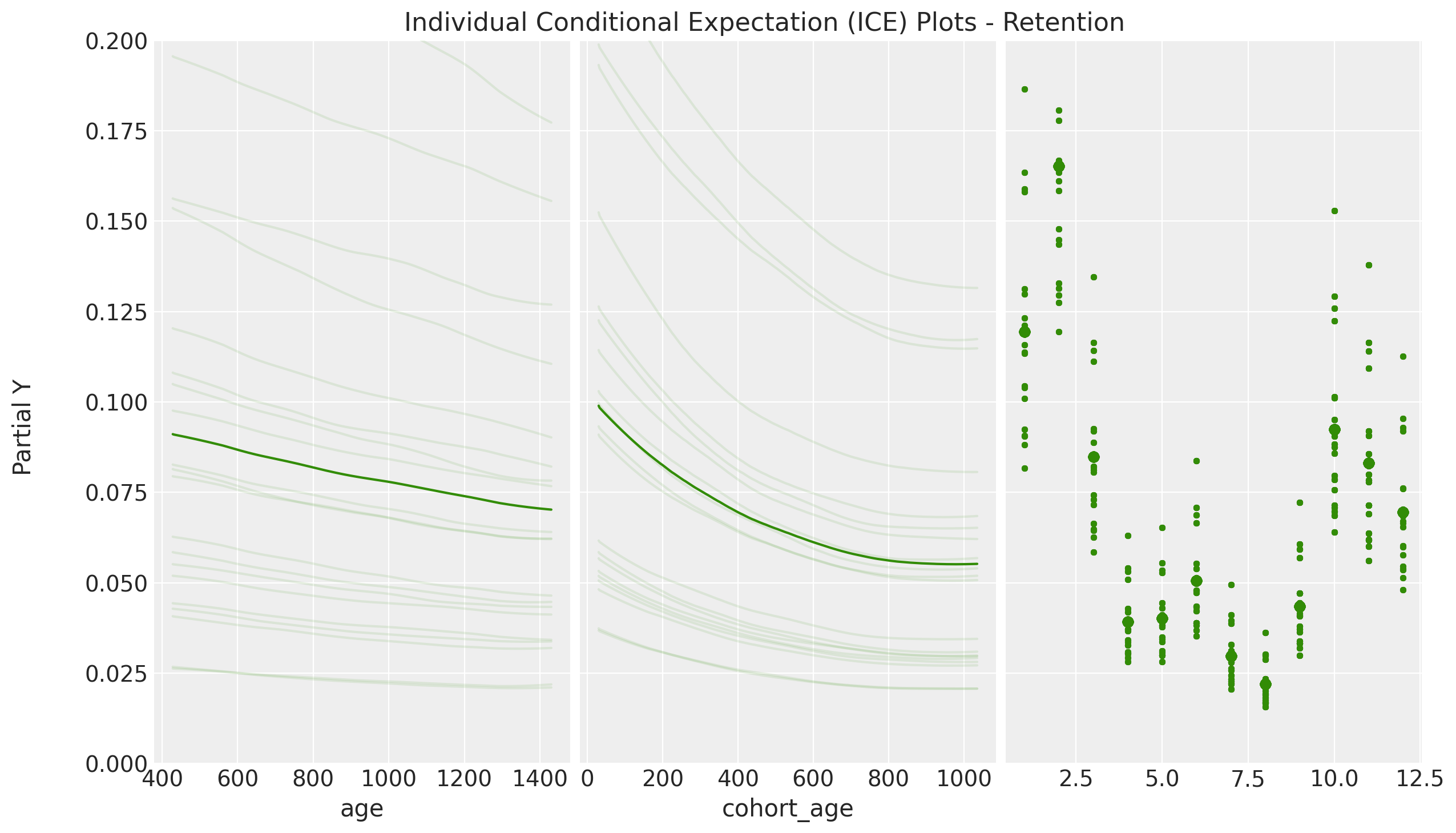

ICE Plot

Revenue

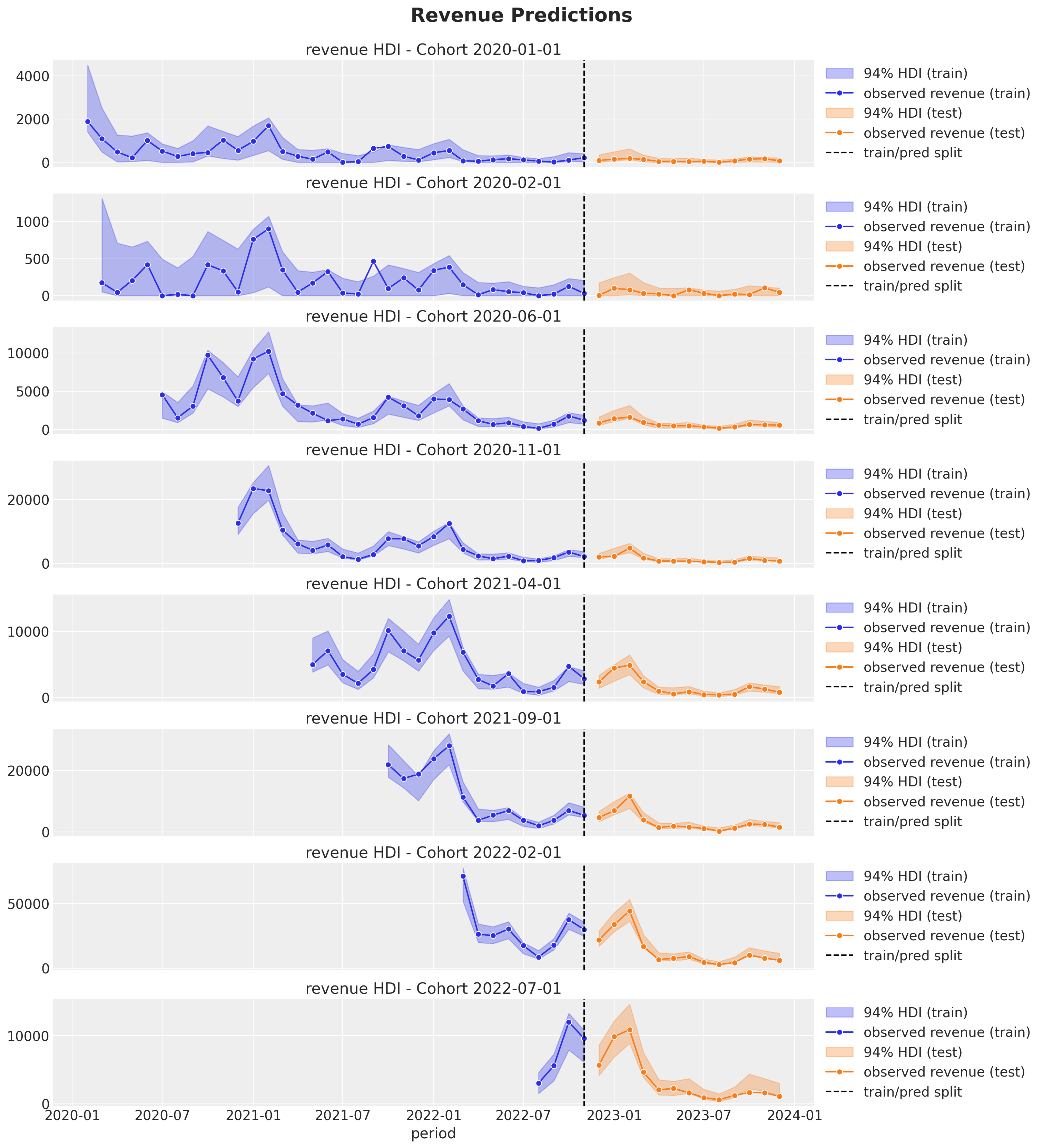

Cohort Revenue-Retention Model

Retention Component

\[\begin{align*} \textrm{logit}(p) & = \text{BART}(\text{cohort age}, \text{age}, \text{month}) \\ N_{\text{active}} & \sim \text{Binomial}(N_{\text{total}}, p) \end{align*}\]

Revenue Component

\[\begin{align*} \log(\lambda) = \: (& \text{intercept} \\ & + \beta_{\text{cohort age}} \text{cohort age} \\ & + \beta_{\text{age}} \text{age} \\ & + \beta_{\text{cohort age} \times \text{age}} \text{cohort age} \times \text{age}) \\ \text{Revenue} & \sim \text{Gamma}(N_{\text{active}}, \lambda) \end{align*}\]

Cohot Revenue-Retention Model

mu = pmb.BART(

name="mu", X=x, Y=train_retention_logit, m=100, response="mix", dims="obs"

)

p = pm.Deterministic(name="p", var=pm.math.invlogit(mu), dims="obs")

lam_log = pm.Deterministic(

name="lam_log",

var=intercept

+ b_age_scaled * age_scaled

+ b_cohort_age_scaled * cohort_age_scaled

+ b_age_cohort_age_interaction * age_scaled * cohort_age_scaled,

dims="obs",

)

lam = pm.Deterministic(name="lam", var=pm.math.exp(lam_log), dims="obs")

n_active_users_estimated = pm.Binomial(

name="n_active_users_estimated",

n=n_users,

p=p,

observed=n_active_users,

dims="obs",

)

x = pm.Gamma(

name="revenue_estimated",

alpha=n_active_users_estimated + eps,

beta=lam,

observed=revenue,

dims="obs",

)Cohort Revenue-Retention Model

Revenue-Retention - Predictions

Some Applications in the Industry

Understand retention and revenue drivers.

Factor out seasonality.

External covariates (e.g. acquisition channel).

Forecast revenue and retention (cohort lifetime value).

Causal Inference

Counterfactural analysis.

Geo experiments.

References

Blog Posts

Packages

Papers

- BART: Bayesian additive regression trees

- Bayesian additive regression trees for probabilistic programming

References

Related Work

“Counting Your Customers” the Easy Way: An Alternative to the Pareto/NBD Model, see

pymc-marketingexample here.How to Project Customer Retention, see

pymc-marketingexample here.

Open Source Packages

Thank you!