Motivated by the great blog post by Understanding CUPED by Matteo Courthoud, we explore a Bayesian approach to CUPED to understand its sensitivity with respect to the covariance parameter \(\theta\) of the pre-post mean model. I will assume that the reader is already familiar with CUPED and has read Matteo’s blog post (highly recommended!). Here we focus on the sensitivity component. We do not do this in full generality but rather focus on the specific example of Matteo’s blog post.

Warning: Please do not take these results too seriously. This is just a sensitivity analysis I simply felt like doing.

Prepare Notebook

import arviz as az

import jax.numpy as jnp

import matplotlib.pyplot as plt

import numpy as np

import numpyro

import numpyro.distributions as dist

import pandas as pd

import seaborn as sns

from jax import random

from numpyro.handlers import do

from numpyro.infer import MCMC, NUTS

numpyro.set_host_device_count(n=4)

rng_key = random.PRNGKey(seed=42)

rng = np.random.default_rng(seed=42)

az.style.use("arviz-darkgrid")

plt.rcParams["figure.figsize"] = [10, 6]

plt.rcParams["figure.dpi"] = 100

plt.rcParams["figure.facecolor"] = "white"

%load_ext autoreload

%autoreload 2

%config InlineBackend.figure_format = "retina"Generate Data

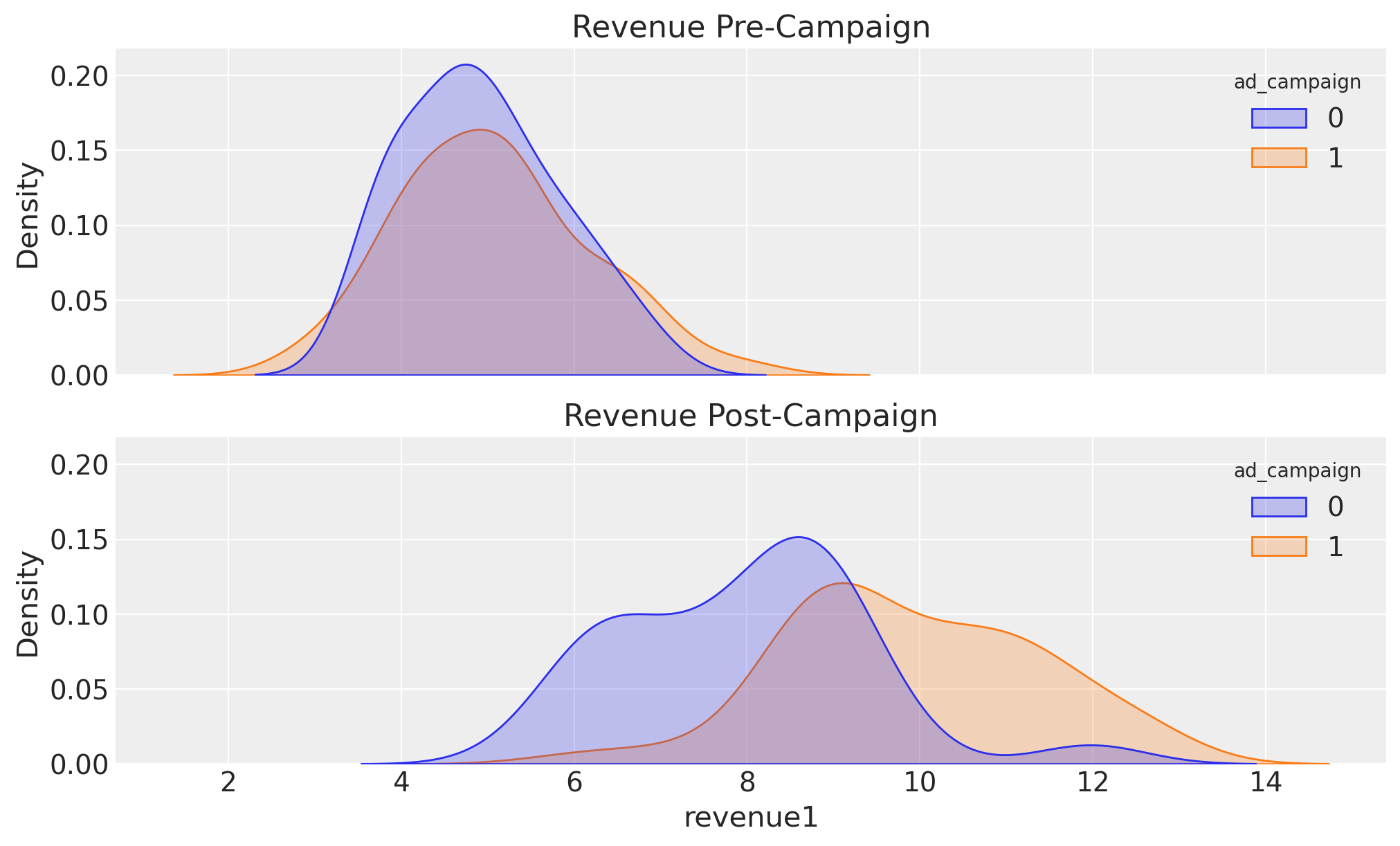

We use a synthetic dataset from Matteo’s repository src.dgp. We simulate a pre and post experiment revenue variable under the presence of an intervention ad_campaign in a randomized controlled trial.

def generate_data(rng, alpha=5, beta=0, gamma=3, delta=2, n=100, seed=1):

np.random.seed(seed)

# Individuals

individual = range(1, n + 1)

# Treatment status

d = rng.binomial(1, 0.5, n)

# Individual outcome pre-treatment

y0 = alpha + beta * d + rng.normal(0, 1, n)

y1 = y0 + gamma + delta * d + rng.normal(0, 1, n)

# Generate the dataframe

return pd.DataFrame(

{"individual": individual, "ad_campaign": d, "revenue0": y0, "revenue1": y1}

)

data_df: pd.DataFrame = generate_data(rng)

data_df.head()| individual | ad_campaign | revenue0 | revenue1 | |

|---|---|---|---|---|

| 0 | 1 | 1 | 5.399774 | 10.394652 |

| 1 | 2 | 0 | 4.094521 | 6.931078 |

| 2 | 3 | 1 | 4.621837 | 9.959412 |

| 3 | 4 | 1 | 6.299228 | 12.706710 |

| 4 | 5 | 0 | 4.643736 | 7.734321 |

fig, ax = plt.subplots(nrows=2, ncols=1, sharex=True, sharey=True, layout="constrained")

sns.kdeplot(data=data_df, x="revenue0", hue="ad_campaign", fill=True, ax=ax[0])

ax[0].set_title("Revenue Pre-Campaign")

sns.kdeplot(data=data_df, x="revenue1", hue="ad_campaign", fill=True, ax=ax[1])

ax[1].set_title("Revenue Post-Campaign");

Effect Estimation: Difference in Means

We can compute the point estimate of the difference in means as follows:

difference_in_means = (

data_df.query("ad_campaign == True")["revenue1"].mean()

- data_df.query("ad_campaign == False")["revenue1"].mean()

)

print(f"Difference in means: {difference_in_means:.3f}")Difference in means: 1.927We are of course interested in quantifying the uncertainty of this estimate. We can do this using a simple linear regression model. We use a Bayesian approach with non-very informative priors, to be able to compare the results with the CUPED approach.

ad_campaign = data_df.ad_campaign.to_numpy()

revenue0 = data_df.revenue0.to_numpy()

revenue1 = data_df.revenue1.to_numpy()def difference_in_means_model(y_post, treatment) -> None:

n_samples = len(treatment)

intercept = numpyro.sample("intercept", dist.Normal(0, 2))

beta = numpyro.sample("beta", dist.Normal(0, 3))

sigma = numpyro.sample("sigma", dist.HalfCauchy(2))

mu = intercept + beta * treatment

with numpyro.plate("observations", n_samples):

numpyro.sample("y_post_pred", dist.Normal(mu, sigma), obs=y_post)

numpyro.render_model(

difference_in_means_model,

model_args=(revenue1, ad_campaign),

render_distributions=True,

render_params=True,

)

mcmc_difference_in_means = MCMC(

sampler=NUTS(difference_in_means_model),

num_warmup=1_500,

num_samples=4_000,

num_chains=4,

)

rng_key, rng_subkey = random.split(rng_key)

mcmc_difference_in_means.run(rng_subkey, revenue1, ad_campaign)

idata_difference_in_means = az.from_numpyro(mcmc_difference_in_means)

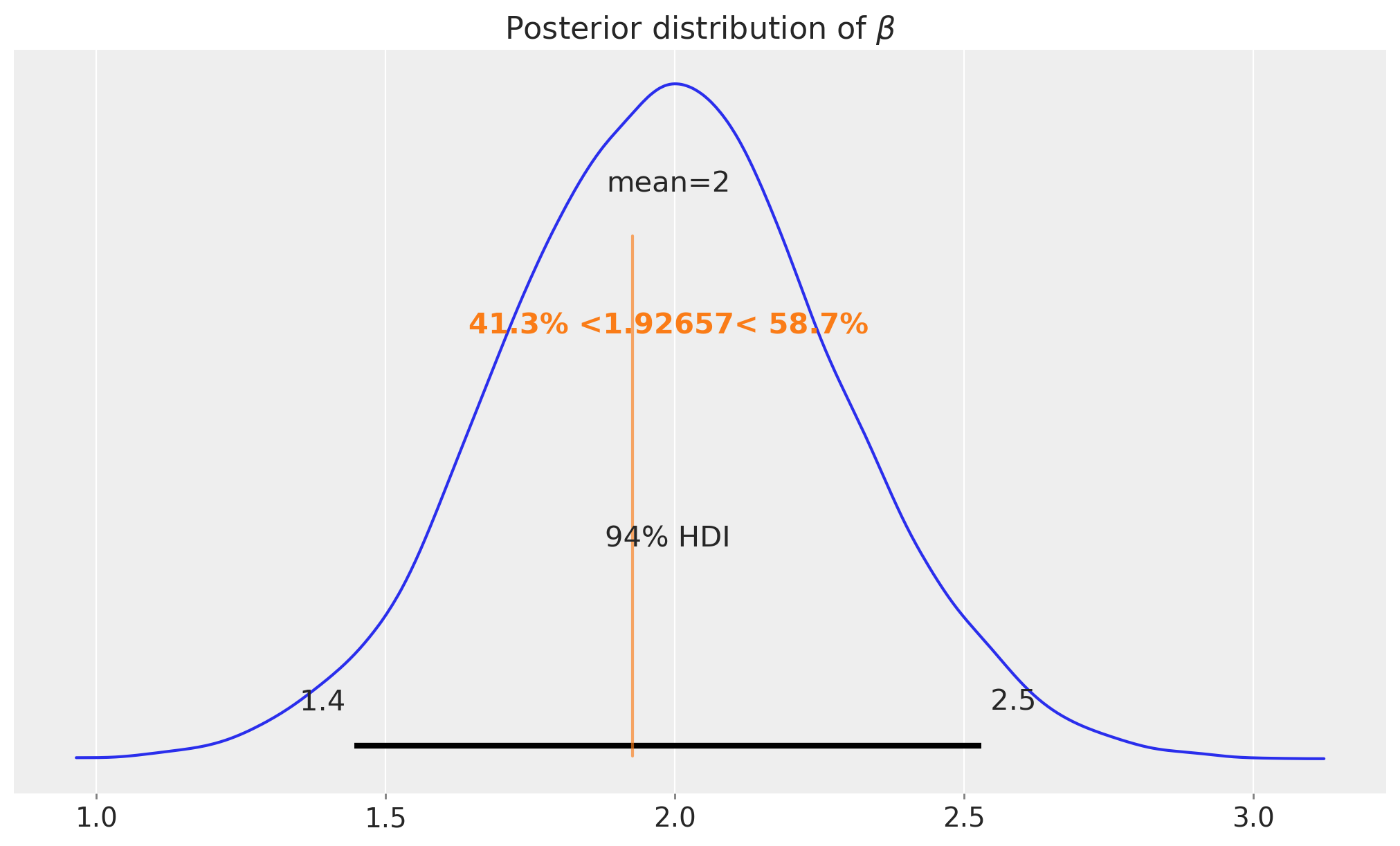

fig, ax = plt.subplots()

az.plot_posterior(

idata_difference_in_means, var_names=["beta"], ref_val=difference_in_means, ax=ax

)

ax.set_title(r"Posterior distribution of $\beta$");

As expected, the posterior distribution of the difference in means is centered around the true value of \(2\) (from the data generating process).

Let’s compute the standard deviation of the posterior distribution:

print(f"std: {idata_difference_in_means['posterior']['beta'].std().item():.3f}")std: 0.286Bayesian CUPED

We now turn to the Bayesian CUPED approach. Recall the algorithm for the CUPED estimator:

- Regress \(\text{revenue}_1\) on \(\text{revenue}_0\) and estimate the \(\theta\) coefficient.

- Compute \(\text{revenue}_{cuped} = \bar{\text{revenue}}_1 - \theta \times \bar{\text{revenue}}_0\).

- Compute the difference in means of \(\text{revenue}_{cuped}\) between treatment and control group.

The motivation of this simulation is: How does the uncertainty on \(\theta\) impact the uncertainty of the CUPED estimate?

To answer this question, we implement these steps in a single Bayesian model (with same non-informative priors as before).

def cuped_model(y_post, treatment, y_pre) -> None:

n_samples = len(ad_campaign)

intercept_target = numpyro.sample("intercept_target", dist.Normal(0, 2))

theta = numpyro.sample("theta", dist.Normal(0, 3))

sigma_theta = numpyro.sample("sigma_theta", dist.HalfCauchy(2))

intercept_cuped = numpyro.sample("intercept_cuped", dist.Normal(0, 2))

beta_cuped = numpyro.sample("beta_cuped", dist.Normal(0, 3))

sigma_cuped = numpyro.sample("sigma_cuped", dist.HalfCauchy(2))

mu_target = intercept_target + theta * y_pre

with numpyro.plate("target_conditioning", n_samples):

numpyro.sample("y_post_pred", dist.Normal(mu_target, sigma_theta), obs=y_post)

y_cuped = numpyro.deterministic(

"y_cuped", y_post - theta * (y_pre - jnp.mean(y_pre))

)

with numpyro.plate("cuped_conditioning", n_samples):

numpyro.sample(

"y_cuped_pred",

dist.Normal(intercept_cuped + beta_cuped * treatment, sigma_cuped),

obs=y_cuped,

)

numpyro.render_model(

cuped_model,

model_args=(revenue1, ad_campaign, revenue0),

render_distributions=True,

render_params=True,

)

mcmc_cuped = MCMC(

sampler=NUTS(cuped_model),

num_warmup=1_500,

num_samples=4_000,

num_chains=4,

)

rng_key, rng_subkey = random.split(rng_key)

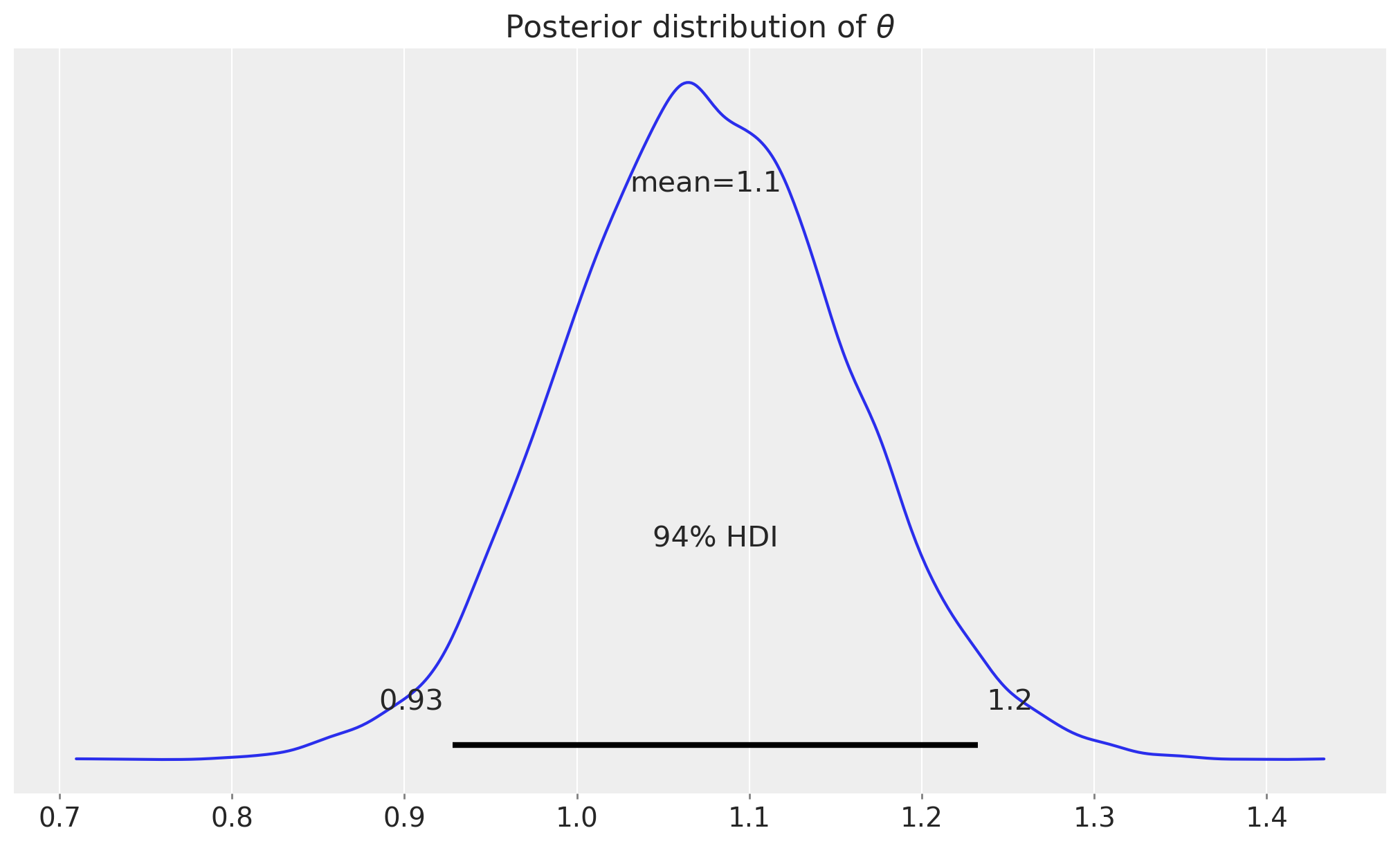

mcmc_cuped.run(rng_subkey, revenue1, ad_campaign, revenue0)First, let’s look into the posterior distribution of \(\theta\):

idata_cuped = az.from_numpyro(mcmc_cuped)

fig, ax = plt.subplots()

az.plot_posterior(idata_cuped, var_names=["theta"], ax=ax)

ax.set_title(r"Posterior distribution of $\theta$");

The point estimate of \(\theta\) is centered around the true value of \(1.1\).

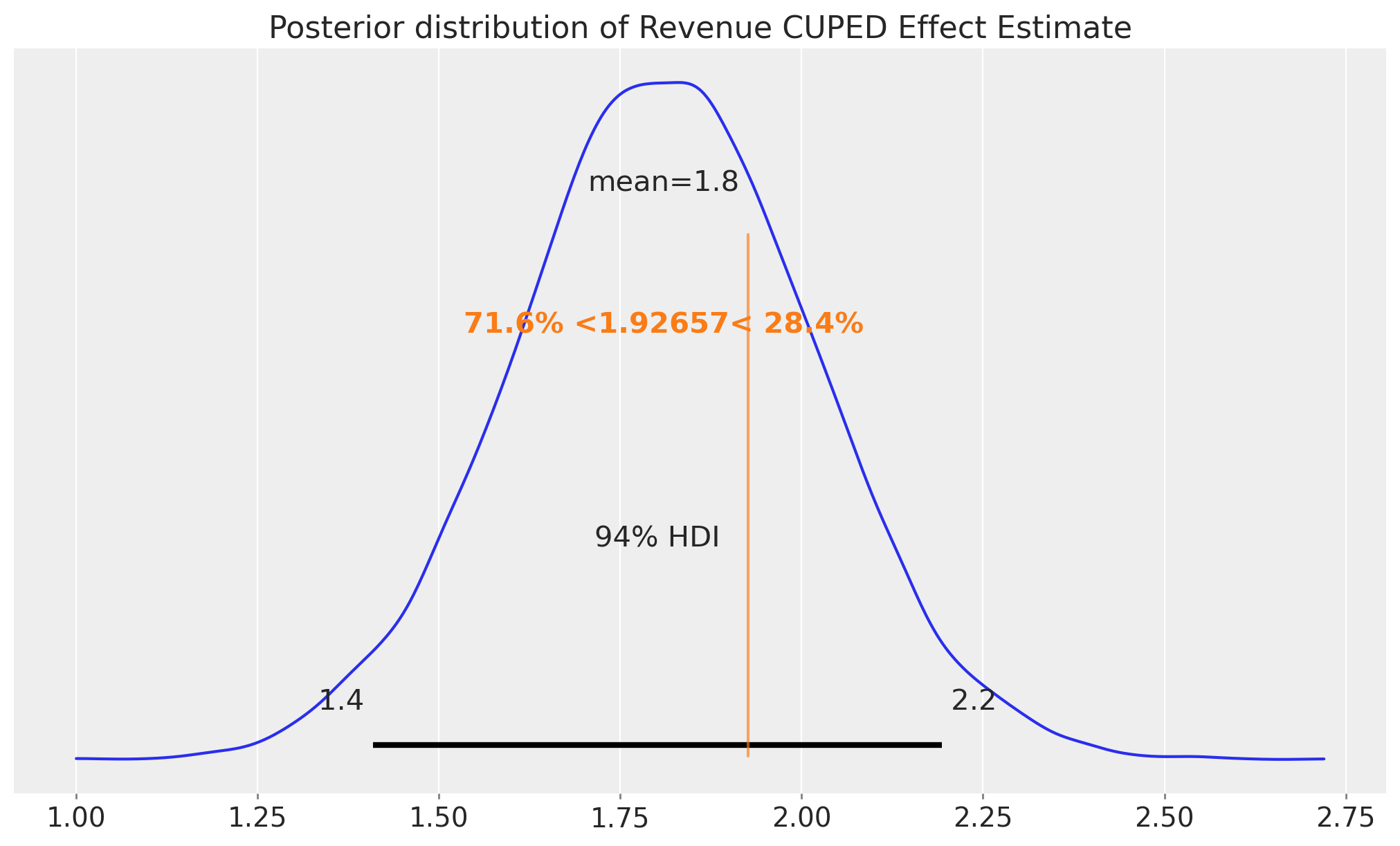

Next we look into the posterior distribution of the CUPED effect estimate:

fig, ax = plt.subplots()

az.plot_posterior(

idata_cuped, var_names=["beta_cuped"], ref_val=difference_in_means, ax=ax

)

ax.set_title("Posterior distribution of Revenue CUPED Effect Estimate");

print(f"std: {idata_cuped['posterior']['beta_cuped'].std().item():.3f}")std: 0.207As expected, the posterior distribution of the CUPED effect estimate is narrower than the one of the simple difference in means. So far so good! The result’s match Matteo’s blog post.

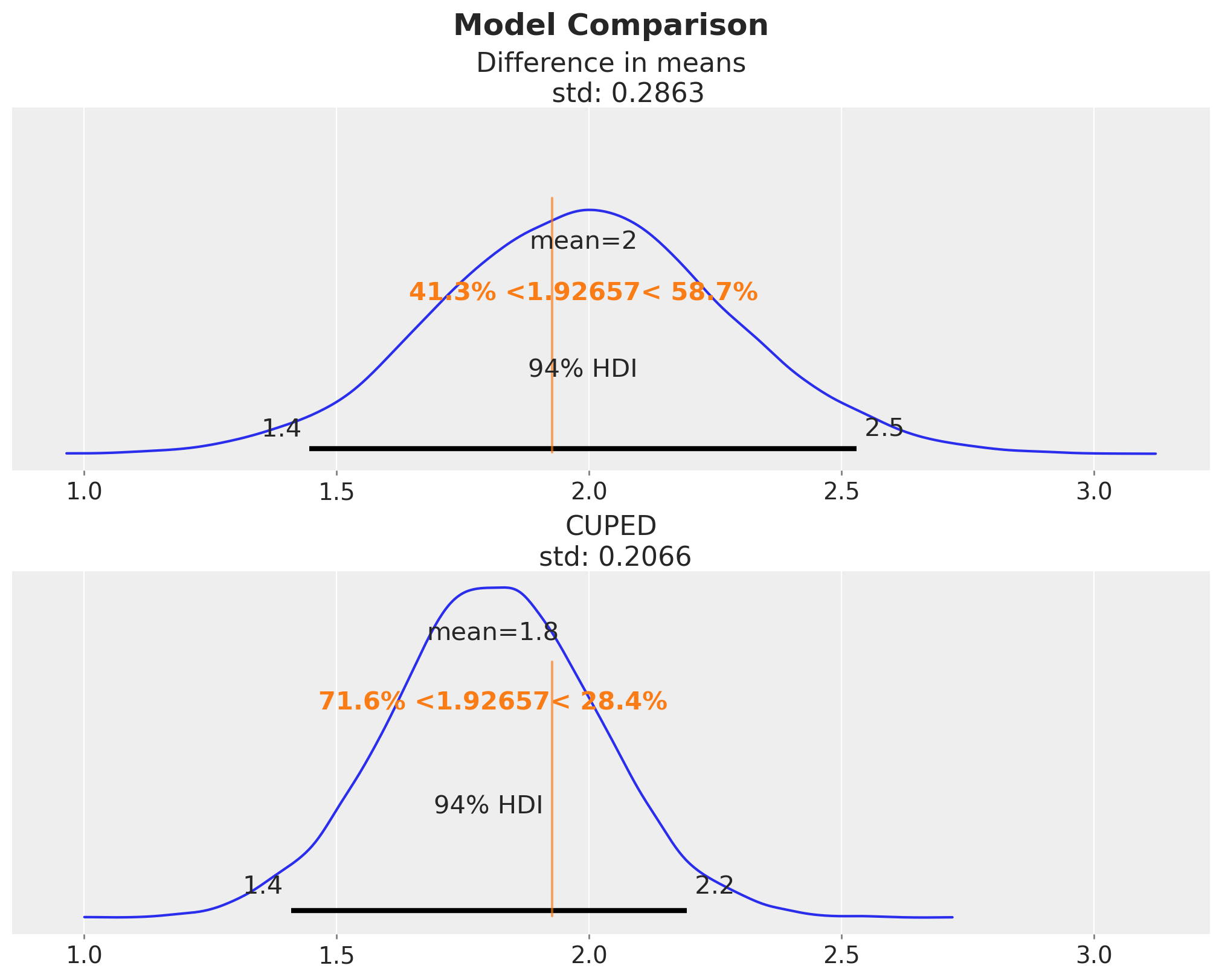

For the sake of completeness, let’s compare the posterior distributions of the difference in means and the CUPED effect estimate:

fig, ax = plt.subplots(

nrows=2,

ncols=1,

figsize=(10, 8),

sharex=True,

sharey=True,

layout="constrained",

)

az.plot_posterior(

idata_difference_in_means, var_names=["beta"], ref_val=difference_in_means, ax=ax[0]

)

ax[0].set_title(

f"""Difference in means

std: {idata_difference_in_means['posterior']['beta'].std().item():.4f}"""

)

az.plot_posterior(

idata_cuped, var_names=["beta_cuped"], ref_val=difference_in_means, ax=ax[1]

)

ax[1].set_title(

f"CUPED\n std: {idata_cuped['posterior']['beta_cuped'].std().item():.4f}"

)

fig.suptitle("Model Comparison", fontsize=18, fontweight="bold");

Here we have a clear visual evidence of the variance reduction of the CUPED model.

Graph Surgery

We now turn to the sensitivity analysis. We want to see how the uncertainty of the CUPED estimate evolves with respect to the uncertainty of the \(\theta\) coefficient.

To do this, we use the do operator to set the value of \(\theta\) to the mean of its posterior distribution. This way we can mimic what we would have done in a traditional two-step approach.

do_cuped_model = do(

cuped_model, data={"theta": idata_cuped["posterior"]["theta"].mean().item()}

)

numpyro.render_model(

do_cuped_model,

model_args=(revenue1, ad_campaign, revenue0),

render_distributions=True,

render_params=True,

)

Notice that we have removed the relationship between \(\theta\) and the revenue1 ~ revenue0 model.

Next, we fit the later model of the CUPED algorithm:

mcmc_do_cuped = MCMC(

sampler=NUTS(do_cuped_model),

num_warmup=1_500,

num_samples=4_000,

num_chains=4,

)

rng_key, rng_subkey = random.split(rng_key)

mcmc_do_cuped.run(rng_subkey, revenue1, ad_campaign, revenue0)

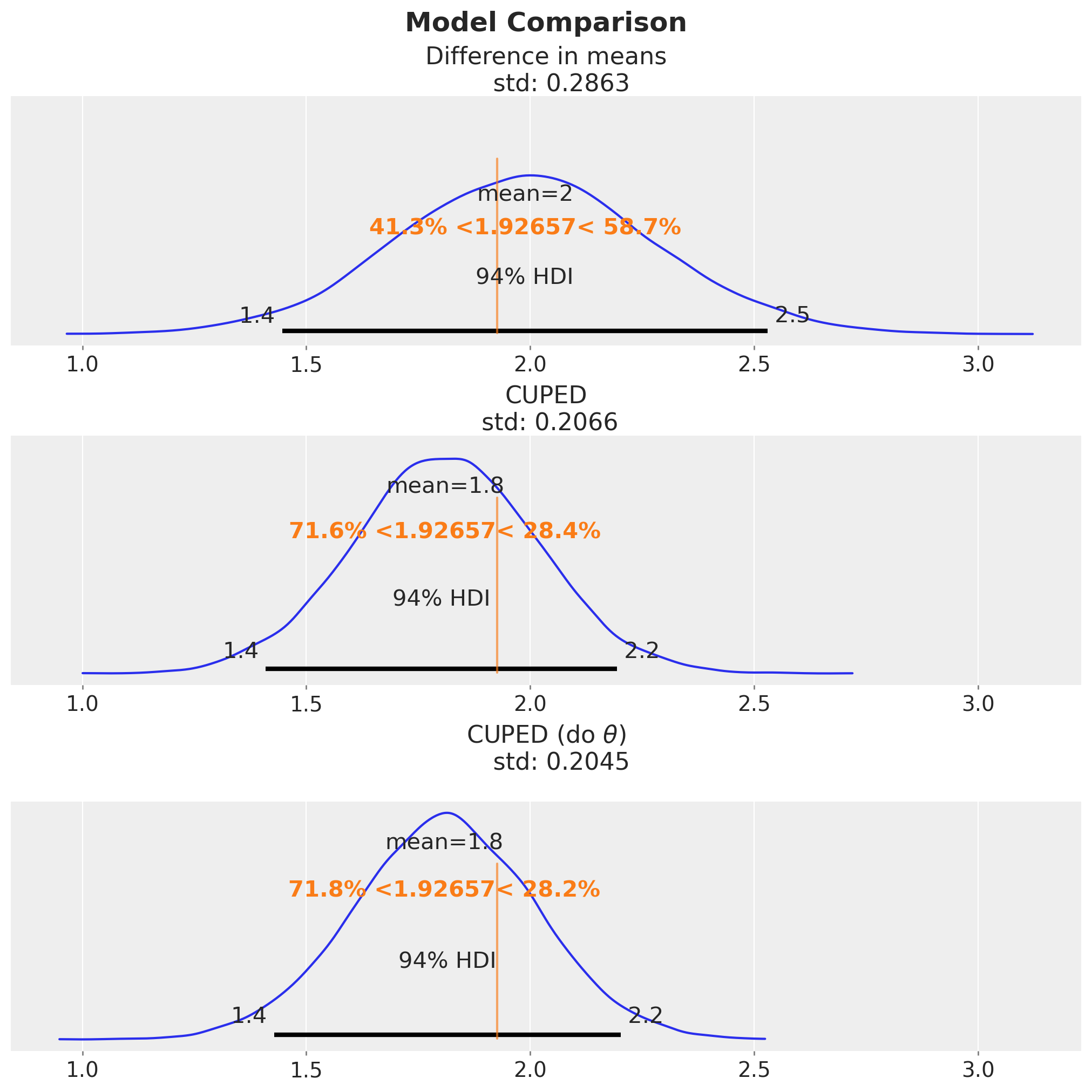

idata_do_cuped = az.from_numpyro(mcmc_do_cuped)Comparison

Finally, we compare all the effect estimation of the three models. In particular, we focus on the standard deviation of the posterior distributions.

fig, ax = plt.subplots(

nrows=3,

ncols=1,

figsize=(10, 10),

sharex=True,

sharey=True,

layout="constrained",

)

az.plot_posterior(

idata_difference_in_means, var_names=["beta"], ref_val=difference_in_means, ax=ax[0]

)

ax[0].set_title(

f"""Difference in means

std: {idata_difference_in_means['posterior']['beta'].std().item():.4f}"""

)

az.plot_posterior(

idata_cuped, var_names=["beta_cuped"], ref_val=difference_in_means, ax=ax[1]

)

ax[1].set_title(

f"CUPED\n std: {idata_cuped['posterior']['beta_cuped'].std().item():.4f}"

)

az.plot_posterior(

idata_do_cuped, var_names=["beta_cuped"], ref_val=difference_in_means, ax=ax[2]

)

ax[2].set_title(

f"""CUPED (do $\\theta$)

std: {idata_do_cuped['posterior']['beta_cuped'].std().item():.4f}

"""

)

fig.suptitle("Model Comparison", fontsize=18, fontweight="bold");

We see that the estimate and uncertainty of the full Bayesian CUPED model is very similar (almost identical) to the one of the CUPED model after graph surgery. The latter standard deviation is just slightly smaller (approximately \(1\%\)) than the one of the full Bayesian CUPED model.

I wonder if this effect could be made more pronounced with a weaker relationship between \(\text{revenue}_1\) and \(\text{revenue}_0\). If you have any input on this, please let me know!